Nifty Hourly Topping Time Cycles with FLD and Neo wave

Nifty Time cycles has been working extremely well. Usually Cycles are used to catch lows but we can use the same in order to catch the tops as well if there is a rhythmic pattern. Time Cycles has to be applied along with Elliott wave / Neo wave for better forecasting ability and prudent trade setup.

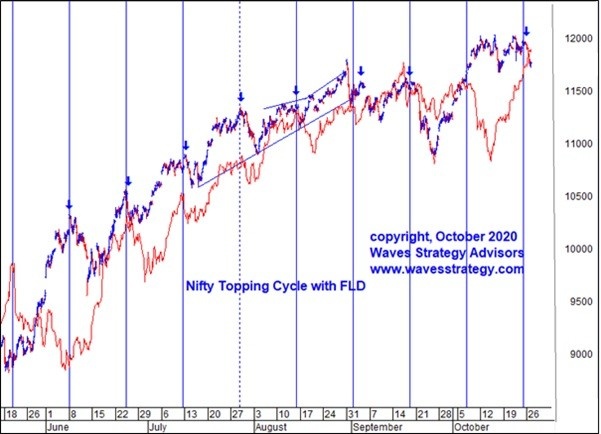

Look at the below chart of Nifty that shows Nifty topping cycle along with Future Line of Demarcation (FLD).

Nifty had showed a sharp move today below the immediate support of 11880 levels. So where is it headed from here on?

Nifty hourly chart: Topping Time Cycles

Nifty hourly chart: Neo Wave pattern as shown in morning research report

Time cycles and Elliott Wave are powerful techniques of forecasting but the same has to be combined with price confirmation methods.

Nifty first chart shows that prices have been rhythmically following a topping cycle very well and has reversed from there on multiple occasions. Along with that there is also a cross below the Future Line of Demarcation (FLD) which has acted as support during the rise and if crossed it has resulted into downside targets equivalent to the distance between the top and the crossover point.

FLD or Future Line of Demarcation is an advanced concept of Hurst’s Time Cycles and one needs to understand that the same cannot be applied without understanding the cycle currently dominant. This concept has been discussed in much detail in our Master of Cycles program and as mentioned one can combined Neo wave patterns for better clarity and trade setups.

Nifty second chart is taken from the daily morning research report that shows prices have been in wave g of the Diametric pattern until today morning. We can see breach below the low of 11770 levels today which increases the odds that wave g might have completed or is possibly forming a triangle pattern. The fall post wave g can be either wave x or start of a bigger downside trend. The speed of the fall and how violent the reversal is will confirm if a bigger degree downtrend has started.

In today’s session Nifty has already moved lower by more than 150 points. So, will the topping cycle work along with the FLD that suggest we are at important cusp of reversal or prices will simply ignore this technical parameter and the greed will continue to drag index higher before we move down eventually! What do you think? For us, staying cautious and prepared is always stood as a better strategy than just being complacent.

Learn these Methods of Combining from the Basic to the advanced concepts in the Mentorship on Technical Analysis starting in November 2020. It does not matter if you are a fresher or already a trader. Market is a teacher for life long and we should understand the language. A mentor has travelled the path and it is always better to learn from the experience especially the pitfalls to avoid, reduce the mistakes, know where to put stops and trade without anxiety. Know more here or contact on +919920422202