Nifty: Trading Diametric Pattern Elliott Wave

Diametric pattern – How to Trade the patterns as per Advanced Elliott wave – Neo wave theory to forecast the next trend.

For successful trading it is very important to understand the overall price pattern. Unless the pattern is clear it is best to avoid the trade.

Below shows how a text book Neo wave Diametric pattern markets are exhibiting

We are closely keeping on tab on Nifty’s price structure along with time taken by each segment to know the pattern under formation. This helps us in forming different strategies so as to leverage from ongoing pattern.

For option traders it is most important to know that whether current trend is going to be sharp or will it take more time to move higher?

Below is the part of research taken from “The Financial Waves Short Term Update” which indicates that there is high probability of Nifty forming Diametric pattern which is 7 legged pattern defined under Neo wave.

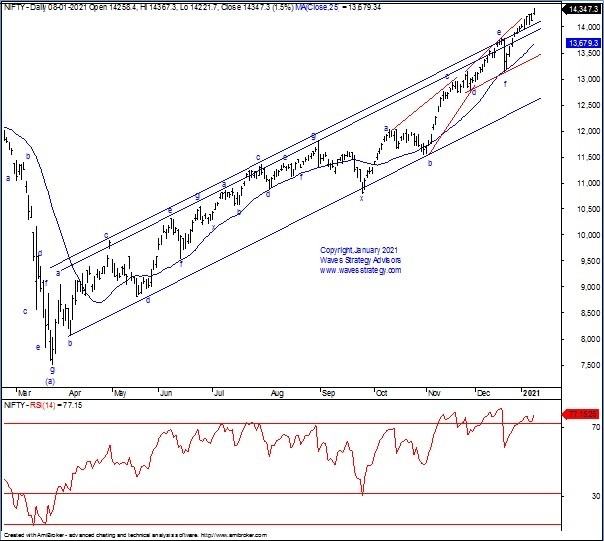

Nifty daily chart Diametric pattern:

Elliott Wave analysis:

It is very important for you to understand the overall pattern under formation so that atleast you are aware that prices are near the cusp.

As shown on daily chart, prices are forming a Diametric pattern. This pattern is recognised in Neo wave as a 7 legged correction and can take a form of either Bow- Tie structure or a Diamond shaped structure. In the above chart we can see a Bow – Tie Diametric pattern.

Each legs are corrective and we are currently in wave g. As of now the pattern is extending but we will get very high conviction trade setup when there is a clear two stage confirmation obtained by last rising segment getting retraced in faster time. However, for traders there will be ample opportunity as volatility is going to be high providing big swings. To encash the next big trend on markets you need to combine this Neo wave pattern with Time cycles.

So what is the next big trend and how to capitalize on the ongoing move?

Subscribe now to “The Financial Waves Short Term Update” which covers Nifty and 3 stocks with in-depth research. For more information visit Pricing Page

Attend the Most Advanced Training on Technical analysis – Trading using Neo wave – Advanced Elliott wave and timing the key reversal areas using Hurst’s Time cycles. The training will be held on 16th – 17th January 2021 Online. For more details Contact US or write to us at [email protected] or what’s app us on +91 9920422202