Trade setup on Crude Using Ichimoku and Bollinger Band

Be in any asset class Elliott wave combined with various indicators such as Ichimoku cloud, Bollinger bands and most basic channelling technique exhibits the most useful trade setup.

Combination of various studies gives us conviction on the direction of the trend. Negative movement seen on MCX Crude was confirmed post using these indictors.

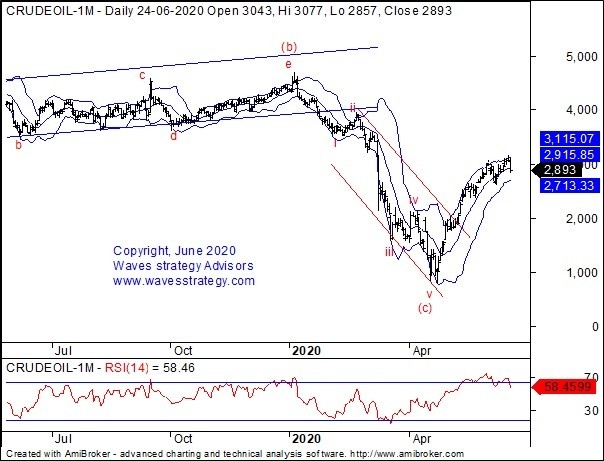

See below the study and application of Bands and cloud on two time frames which altogether suggest selling in the commodity.

MCX Crude Daily chart with Bollinger Bands. MCX Crude Daily chart with Ichimoku cloud.

Elliott wave Analysis-

Crude post forming high near 3153 levels prices have reversed drastically on downside.

Bollinger Bands- We have applied band on daily chart which clearly indicates selling has emerged. As you can see price has reversed exactly from the upper band and given closed below the middle band which suggests negative momentum. As per wave counts we seem to be moving in complex correction wherein currently wave (x) is unfolding

Ichimoku Cloud: As shown on hourly chart, red channel is working extremely well from where prices have reversed from channel resistance. Also prices have dragged down below the cloud plus prices placed below the base and conversion lines which confirm negativity. Wave count also suggests wave (x) blue is in progress on downside.

In short, MCX Crude remains bearishness as long as we do not see any sign of reversal on upside on the above indicators.

Following are the calls given today on intraday basis to our existing Intraday clients:

25/06/2020 (12.28pm) CRUDE FUT SELL BELOW 2845 SL 2880 TGT1 2825 TGT2 2792.5 – TARGET 1 ACHIEVED AT (1.30pm)

To know what will be the next move of Crude subscribe to our daily commodity report. It also covers short term view on GOLD, SILVER and Copper, Register here

We provide Intraday / Positional calls on these commodities along with research reports using these techniques through Whatsapp, SMS. For more details, Click here