12th February 2018

Equity markets can stabilize in this week after sharp correction. Expect range bound movement!

Following is the English transcript of the article published in Economic Times section of Navbharat Times by Ashish Kyal, CMT published today morning before markets opened.

Equity markets can stabilize in this week after sharp correction. Expect range bound movement!

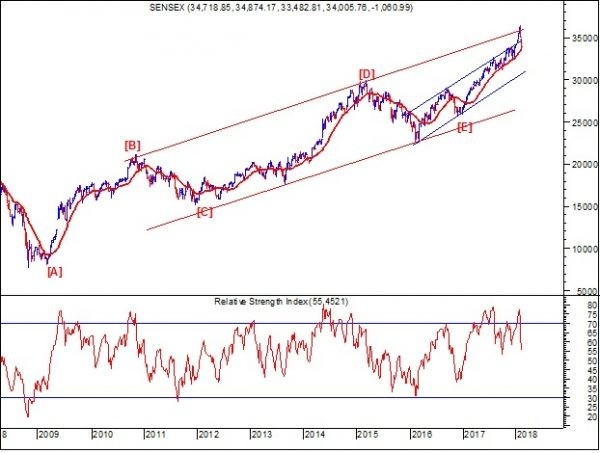

Indian Equity markets showed sudden and sharp reversal from the start of the month. Prices decline after the Budget session on 1st February. Sensex made life time highs near 36444 and made a low near 33482 on 6th February. This was a fall of nearly 2960 points in just a few days of time. The selloff cannot be contributed to Budget policy outcome alone but also to the weakness seen in Global equity markets. Introduction of Long term capital gains – LTCG did hit the sentiments of investors but this followed by global equity selloff resulted into sudden decline on Indian equity markets.

Global markets – US Equity index – DJIA showed one of the biggest declines over past few days falling more than 12% in just over 2 weeks. Other major equity indices like UK index – FTSE, Hong Kong index – Hang Seng, Japanese index – Nikkei225 all showed sharp fall. Such systematic selloff of this magnitude was previous seen during the fall of 2007 – 2008. It is therefore important for investors to remain cautious and buy only stocks with attractive valuations.

Prices to Earnings ratio remains a concern – Price to earnings ratio (PE) remains a concern. This fundamental parameter touched 27.81 levels in January 2018. Such elevated level was previously seen during January 2008 before the crash. Many of the Midcap and Smallcap stocks have crossed the level of even 100. This clearly reflects that prices have deviated from their fundamental valuations and therefore correction after such big rally is a healthy sign.

Sharp depreciation in Indian Rupee – Indian Rupee depreciated sharply against basket of currencies GBP, JPY and EURO since start of 2018. Such sharp fall in INR against this major currency pairs risk the fear of money flowing out of the country to safer assets. It will be important to see if currency markets also stabilize over next few weeks.

Bond yields a concern – Bond yields across the global markets have been on a rise. With rise in inflationary pressure it is feared that interest rate cycle has also changed. Such reversal will eventually impact the Equity markets. In normal economic cycle during inflationary mode it is the Bond prices that top out first followed by Equity and then commodities. So, if Bond prices have reversed already, eventually the pressure will be seen in equity markets. Indian Bond yields have also risen steadily over past few weeks raising concerns that the interest cut cycle is over.

Week ahead – Given the above fundamental and technical insights looking at the overall price pattern there is possibility that Sensex can show some stability in this week. Prices have important support near 33480 on downside and resistance at 34900. This is the broad range within which we can expect prices to move. Investors and traders should maintain strict stoploss and buy only the stocks that are fundamentally sound and are trading at attractive valuations!