Gold’s 10% Rally: Power of Time Cycles

Dec 17, 2025

It is remarkable how Time Cycles can precisely anticipate early reversals in Gold, just as effectively as they do in stocks and indices.

We captured more than 10% rally in Gold well before it began using Time Cycles and simple price indicators. Gold not only achieved our projected targets but also moved decisively beyond them. This insight was highlighted in our previous Monthly Report published in the month of November 2025, where we had anticipated the rally in advance.

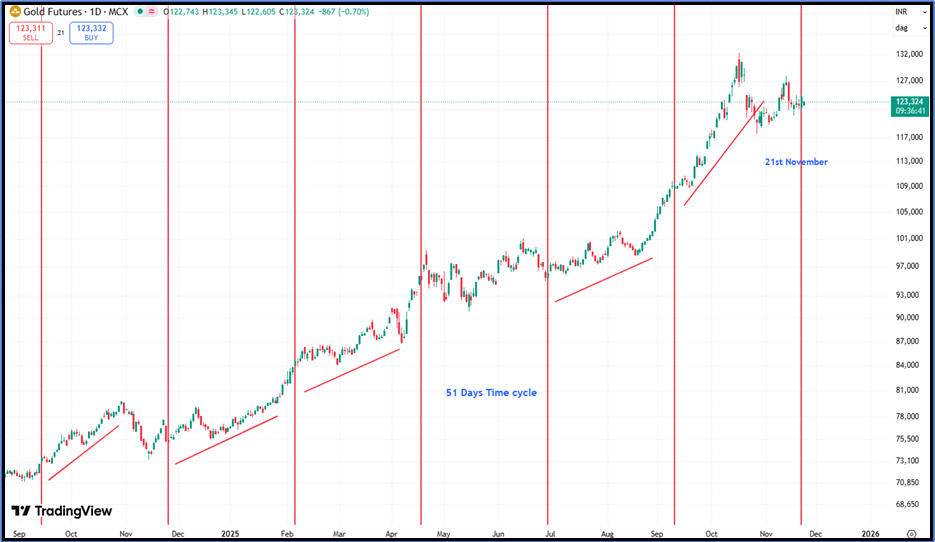

MCX Gold Daily chart Anticipated in our Monthly report as on 24th November 2025

Anticipated as on 24th November 2025

51 Days’ Time cycle: Gold on the daily chart continue to respect the 51-day Time Cycle exceptionally well. Each cycle low has acted as a key turning point, triggering a fresh leg of rally and maintaining the broader structural uptrend. Over the past several months, price consistently formed higher lows around each cycle date, confirming strong buying interest and validating the reliability of the 51-day rhythm. The rising swing lows highlighted on the chart shows that every cycle completion has resulted in bullish follow through. The 51 Days’ Time cycle: Gold on the daily chart continue to respect the 51-day Time Cycle exceptionally well. Each cycle low has acted as a key turning point, triggering a fresh leg of rally and maintaining the broader structural uptrend.

Over the past several months, price consistently formed higher lows around each cycle date, confirming strong buying interest and validating the reliability of the 51-day rhythm. The rising swing lows highlighted on the chart shows that every cycle completion has resulted in bullish follow through. A break above 127900 can put cycle on the buy side which can result into a strong upside reversal.

In nutshell, Gold is currently undergoing a corrective Wave C, likely forming a flat pattern. Prices are positioned at a crucial juncture with the ongoing Time Cycle. On the upside, a break above 124600 will be the first sign of a positive reversal, potentially turning the cycle on the buy side and opening the gates for a rally towards 128100 levels. However, on the downside, a move below 120800 may extend Wave C further lower towards 118800 levels.

MCX Gold hourly chart Happened as on 17th December 2025

Happened -

In our November Monthly Report, we identified a key time-cycle zone in Gold, signaling a high probability of reversal. As expected, Gold formed a precise low near 121600 and subsequently rallied over 10%, comfortably surpassing our projected target of 128100.

This move highlights the power of Time Cycle analysis in spotting potential lows and trend reversals well in advance, even when market sentiment is negative. It also reinforces that time-based methods work effectively across asset classes, including commodities.

In a nutshell, the current trend for Gold continued to be on the side of the bulls as per the concepts of Time trading. As of now, one should use dips as a buying opportunity for better risk reward. On the downside, 132400-132200 is the nearest support.

Mentorship: Learn to Time the Market with Brahmastra

If you want to truly master the art of timing the market, you can learn the complete framework in just three months through the Brahmastra Mentorship Program.

This is not a theoretical course — it is a hands-on mentorship designed to transform the way you analyze and trade the markets.

What You Will Learn

- How to time the market using cycles with precision

- How to combine time cycles + NeoWave + stock selection algorithms

- Clear trade setup strategies with predefined rules

- How to derive accurate stop-loss and target levels

Exclusive Benefits

- Access to a private community of serious traders

- Real-time guidance and learning support

- Limited seats to maintain personal attention and quality

The Brahmastra Mentorship can completely change the way you see the market — giving you the confidence to time entries, exits, and major turning points with a structured, rule-based approach.

If you want more details or wish to apply, fill the form below.