Nifty surge by more than 800 points? How did we see it coming?

Oct 16, 2025

Two important ingredients of predicting market are Wave theory and Time Cycle.

Nifty advanced Elliott wave – Neo wave pattern provide strong forecasting ability right from short to long term forecasting

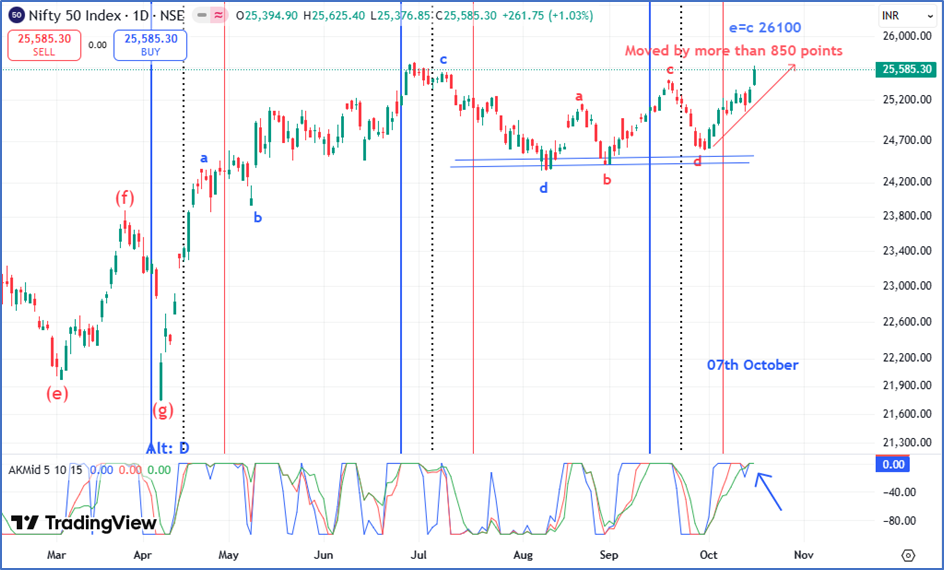

Below is the chart which shows a detailed path of Nifty when majority of the crowd were bearish which we discussed in our short-video that I published it on my YouTube channel and Weekly announcement in from of 1000’s of participants.

Nifty Daily chart: Anticipated as on 02nd October 2025

Nifty Daily chart: Anticipated as on 07th October 2025

Nifty Daily chart: Happened as on 16th October 2025

As discussed earlier, Nifty was near its last thrust of its 55 Days’ Time cycle i.e. near 07th October 2025 and we expect Nifty to make a short-term low near 24728 levels and we anticipated this when majority of the investors were bearish.

We expected the Index to witness a move of more than 800 points and BANG ON!! Index blasted and have witnessed a move of more than 850 points on the upside since. This is the power of Time trading!

Neo Wave perspective - As per the Neo wave guidelines, in a diametric pattern wave e usually lean-to equality towards wave c which gives the forecasted target of 26100 levels on the upside. As expected, wave d got completed on the downside and post which the rise has been unfolding in the form of wave e. Currently, prices have completed more than halfway journey towards the given targets of 26100 levels and one can expect this up move to continue until we see a close below prior day’s low.

Ak Indicator - The indicator below the price chart is a custom indicator made by me to identify potential reversals, trend of the index or stock and momentum. When all the 3 lines of this indicator is at the upper 0 line it represents strength in the trend.

As of now, all the 3 lines have merged on the upside which is a buy signal and one can look for buying opportunities in the Index in respect to the risk reward.

Combining these advanced tools with simple price action it allows investors to form powerful trade setups, giving us a clear edge in the market.

In a nutshell, Nifty finally managed to close above its previous swing high of 25448 levels. For now, one should avoid catching tops and use dips to ride the ongoing trend for better risk reward with targets of 26100 or higher. On the downside, 25361 Gann levels remains as a crucial support for the Index.

Trishul Membership – Options Trading with Elliott wave, Neo wave, Ichimoku cloud, and sacred science of trading & forecasting is covered in the Options Mantra Live Sessions - 8th - 9th Nov & Sutra of Waves Live Session - 6th - 7th Dec. Limited seats available. Fill the form now:: https://www.wavesstrategy.com/trishul-form

Brahmastra (Mentorship on Timing the market) – Learn to trade the market with an edge of Time cycles, Elliott wave, Neo wave concepts and much more. This comprehensive program will run for more than five months, empowering you to apply these strategies independently. Fill the below for more details