Ambuja Cements – Should you buy or sell? Analysis using Time Cycles.

Sep 30, 2021

Like this Article? Share it with your friends!

Ambuja Cements is currently at an important price point and it is difficult to judge if one must buy or sell at current levels based on basic technical tools alone. In such cases, one can take advantage of advanced technical tools like Time Cycles. Check out the Analysis below on how one can trade the stock at current levels.

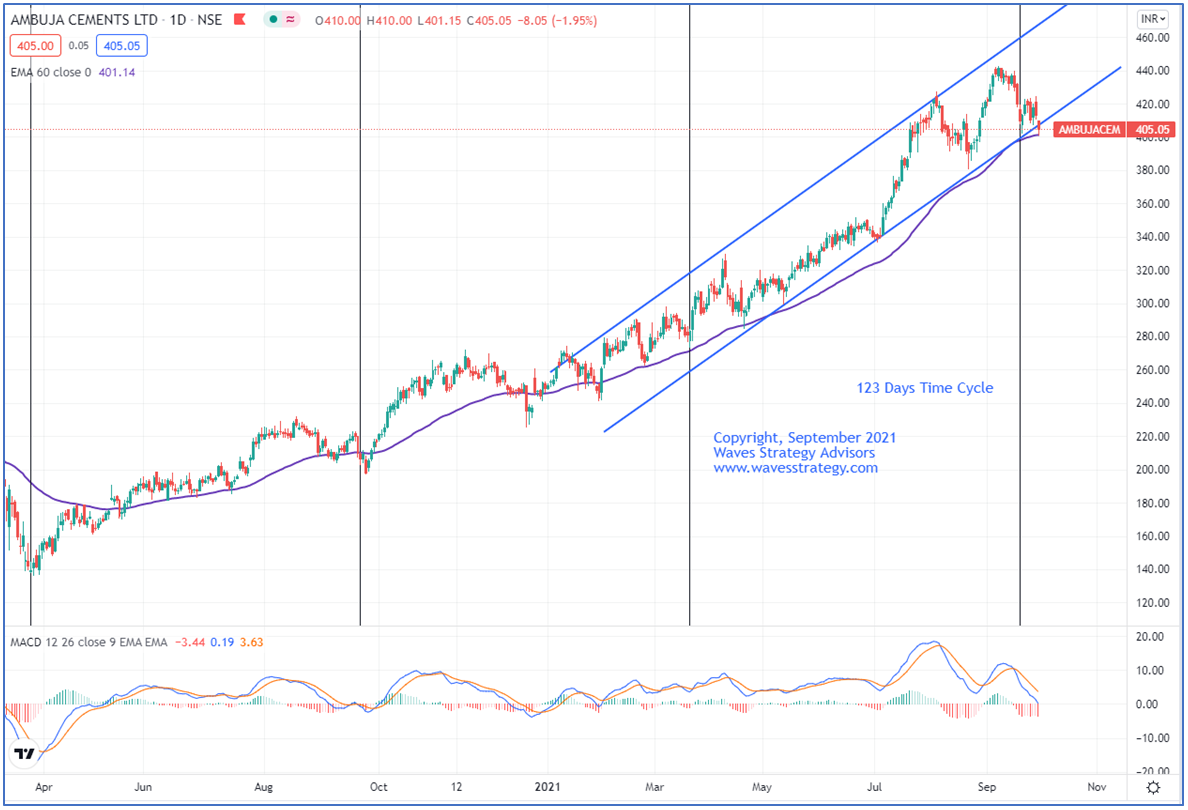

Ambuja Cements Daily chart with 123 day Time Cycle:

In the above daily chart of Ambuja chart, we can see that the vertical lines plotted are of the 123-day Time Cycle where important lows have been forming since April 2020. Now the stock has recently formed a time cycle low on 21st September but since then the stock has failed to create a higher high. In fact, it is now trading near 60-day EMA which has been acting as strong support for the rally since almost June last year.

Now there are two possibilities here, If the stock bounces from the 60 EMA and breaks above 425 levels then it will confirm that a cycle low has been formed and it will be a buying signal. Whereas a decisive close below the low of 400 levels formed on the cycle day will indicate that the cycle low has been breached and the cycle will have entered in sell mode and short positions can be created. A close below 400 levels will also be supported by MACD crossing below the zero line which is already showing negative divergence, thereby confirming a bearish bias to short sell.

Thus using Time cycles we can have a clear objective view for timing the market along with other indicators to add confirmation.

Master of Cycles Simple strategies like these are very effective in systematic trading. One can learn the right way to plot time cycles in our upcoming Master of Cycles program on 9-10th October 2021, Limited seats only. Click here to know more details.

Mentorship on Timing the Markets for the FIRST TIME EVER starts November 2021 – In this Mentorship program, all the necessary tools are given right from stock selection methods, strategy, follow-up action to derive a complete trade setup in step by step fashion. To know more fill the form below: