Bajaj Finance - Sharply Down But Time to BUY? Volume Profile, KST Method

Jun 04, 2025

Bajaj Finance is moving down over past few days. Prices are nearing crucial support levels on downside, But is it time to buy?

Volume profile helps to derive price action area which helps to identify accurate entry and exit. Along with this, Keltner Channel and KST combined is a powerful setup, one can use it directly to trade options.

This setup helps traders to catch the momentum early so that one can stay ahead of the majority crowd. This setup can be used in stocks as well which can be seen below: -

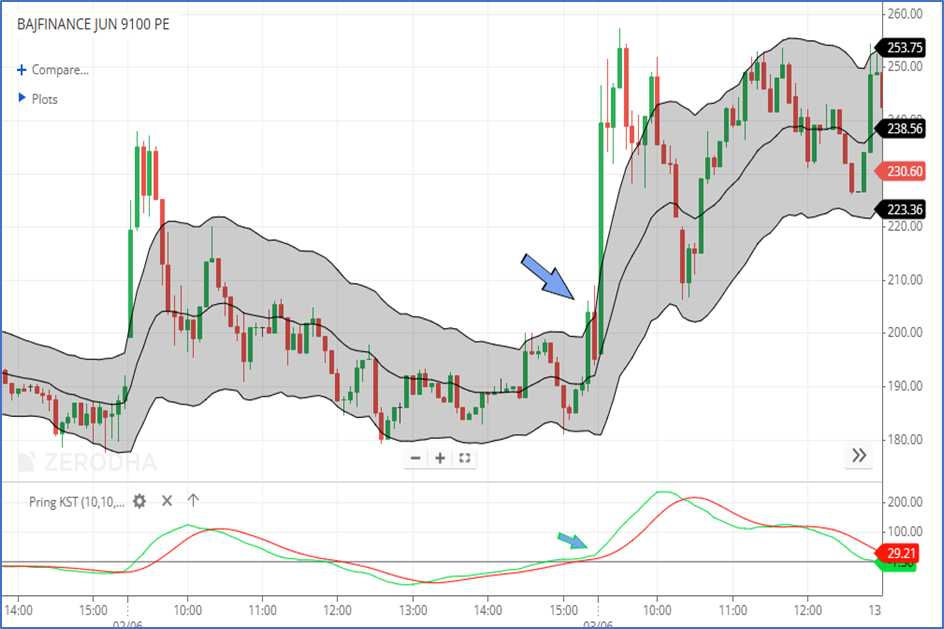

Bajaj Finance 30 Minutes Chart with Volume Profile: Bajaj Finance 9100 Put Options 5 min chart:

Bajaj Finance 9100 Put Options 5 min chart: Volume profile shows big player activity. In Bajaj Finance Volume point of control area is near 9200(fut) levels. This is the area where highest cumulative volume has taken place. This acts as a resistance or support. Prices recently gave a breakdown from it and we saw a sharp selloff as the Volume point of control was broken down. This also indicated that on intraday or short term basis one can look forward to buy puts or short futures. Let us look at how to combine options to derive trade along with this information.

Volume profile shows big player activity. In Bajaj Finance Volume point of control area is near 9200(fut) levels. This is the area where highest cumulative volume has taken place. This acts as a resistance or support. Prices recently gave a breakdown from it and we saw a sharp selloff as the Volume point of control was broken down. This also indicated that on intraday or short term basis one can look forward to buy puts or short futures. Let us look at how to combine options to derive trade along with this information.

Options Trading Strategy -We have shown Keltner Channel and KST momentum indicator on the Bajaj Finance 9100 PE strike.

Keltner channel shows if there is a significant movement and breakout in one direction. This has to be accompanied by KST moving above the 0 line as well. Also, just a breakout on Keltner Channel is not sufficient as it has to be looked in conjunction with momentum indicator. So on, 3rd June 2025, the confirmation candle took out the high of the breakout candle which gave a buy signal on Put Options according to the setup. We have seen put option rising from 210 levels to 257 levels in just matter of few minutes.

The above strategy is used for Intraday trading but can be applied for positional trade setup as well by changing time frames. Understanding exact application of Keltner Channel with KST is utmost important.

Trishul Membership – Options Mantra (OM) is starting on 7th – 8th June 2025 followed by Elliott wave and Sutra of Waves (SOW). Ensure to be a part of this Trishul Membership to get bonus videos, Only a few seats remaining. Fill below form for more details: