Bank Nifty 54-Day Time Cycle: Perfect Timing for the Recent Breakout

Feb 10, 2026

Neo Wave analysis, when combined with Time Cycle studies, helps create high-probability trade setups with greater accuracy by aligning price structure with timing, allowing traders to identify stronger entries, better risk control, and more reliable market reversals.

Using the power of Time cycle and Neo wave, we anticipated Bank Nifty's next move in our Aakash monthly report that was published on 23rd January 2026— Check it out!

Take a look at how this move was forecasted ahead of time. Here’s the detailed research—check it out!

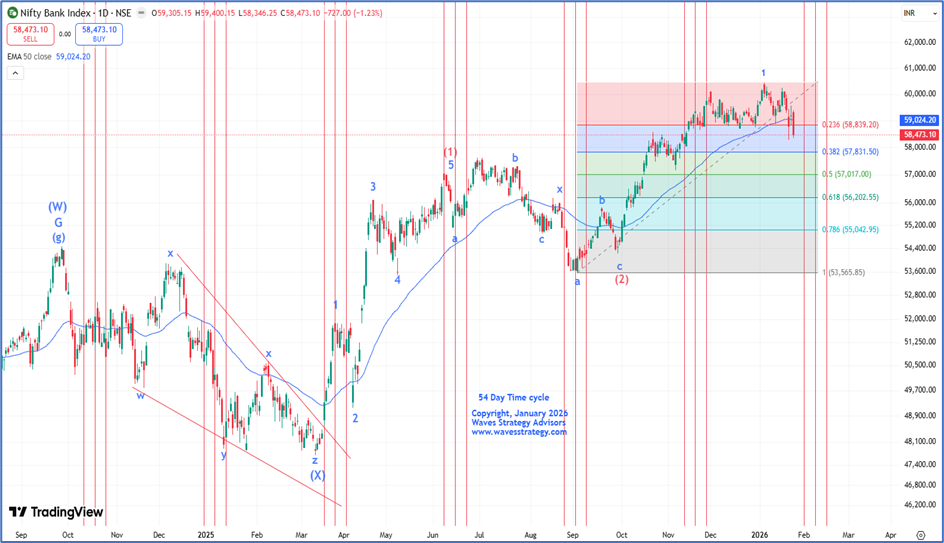

Bank Nifty Daily chart anticipated as on 23rd January 2026

Anticipated Analysis as on 23rd January 2026

On the daily timeframe, Bank Nifty closed below the 50-day exponential moving average for the first time, marking a negative technical development. Over the last five trading sessions, prices have repeatedly failed to close above prior day’s high, indicating strong selling pressure at higher levels. In terms of retracement, the index has already retraced 23.6 percent of the entire rally that started in September 2025. The next retracement level of 38.2% is placed near the 57800 zone which is close to the Gann support of 57961.

From a time-cycle perspective, Bank Nifty is approaching an important cycle window, which is due around the start of February, with the cycle clustering near 09th February. These time cycles have worked reliably in the past, and therefore, there exists a strong possibility of continued pressure over the next two weeks, especially when viewed alongside the Union Budget outcome. In this context, 9th February emerges as a critical date that market participants should keep a close watch on, as it may coincide with a meaningful shift or acceleration in price action.

In a nutshell, from a structural perspective, Bank Nifty may have completed an impulsive rise on the upside; however, it is too early to draw a definitive conclusion at this stage. The current price action suggests that the index is undergoing a corrective phase, with prices moving lower in the form of Wave 2. Based on this structure, Bank Nifty can extend its corrective move towards the 57800 level in the near term.

For any improvement in sentiment and a shift towards positivity, Bank Nifty must decisively move back above the 59200 level. Unless a sustained close above 59200 is witnessed over the short term, the index is likely to remain under pressure, and corrective moves can continue.

It is important to highlight that Bank Nifty has been the relative outperformer, leading the market on the upside even during phases when the Nifty index has been under pressure. As a result, Bank Nifty now becomes a key trigger for the coming weeks, with its price behaviour likely to decide the directional trend for the broader Indian equity markets.

On the downside, any close below 57800 will be a clear sign of concern, as such a breakdown can expose the index to further weakness towards the 57000 zone.

Bank Nifty Daily Chart Happened as on as on 10th February 2026

Happened: In our monthly report, we highlighted the possibility of a short-term bottom forming near the time-cycle zone. We clearly stated that a decisive close back above 59200 could trigger a reversal towards the upside, with strong support placed near 57800 which should remain protected on closing basis— and the market delivered exactly as anticipated.

Bank Nifty remained under pressure initially, eventually forming a low near 57783, before staging a sharp reversal from those levels. The index then went on to rally strongly and register a fresh record high near 61764.

This entire move was projected well in advance using the combined power of Time Cycle Analysis and Wave Theory, once again underscoring the effectiveness of this framework in anticipating major trend reversals and high-probability market moves.

In a nutshell, the broader trend for Bank Nifty continues to remain positive. A decisive breakout above 60870 could open the door for further upside towards the 61675 Gann level. On the downside, the 59903 Gann level is a crucial support and should remain protected to maintain the bullish bias.

Brahmastra Mentorship: Timing the Markets

A limited-seat mentorship program focused on:

- Basics to advanced technical analysis

- Elliott Wave & Neo Wave

- Time cycles

- Stock selection algorithms

- Complete understanding of chart patterns

- Exclusive mentorship sessions

- Simple, practical trade setups that actually work

Fill below form for more details