Bank Nifty Ichimoku Cloud and Elliott Wave

Apr 07, 2022

Like this Article? Share it with your friends!

Bank Nifty showed a sharp rise on upside after the announcement of HDFC merger with HDFC Bank on 4th April 2022.

The entire up move is retraced back equally fast and the event seemed to be short lived. We therefore believe that applying Elliott wave is the best way to see the blueprint of the market and then take trades accordingly.

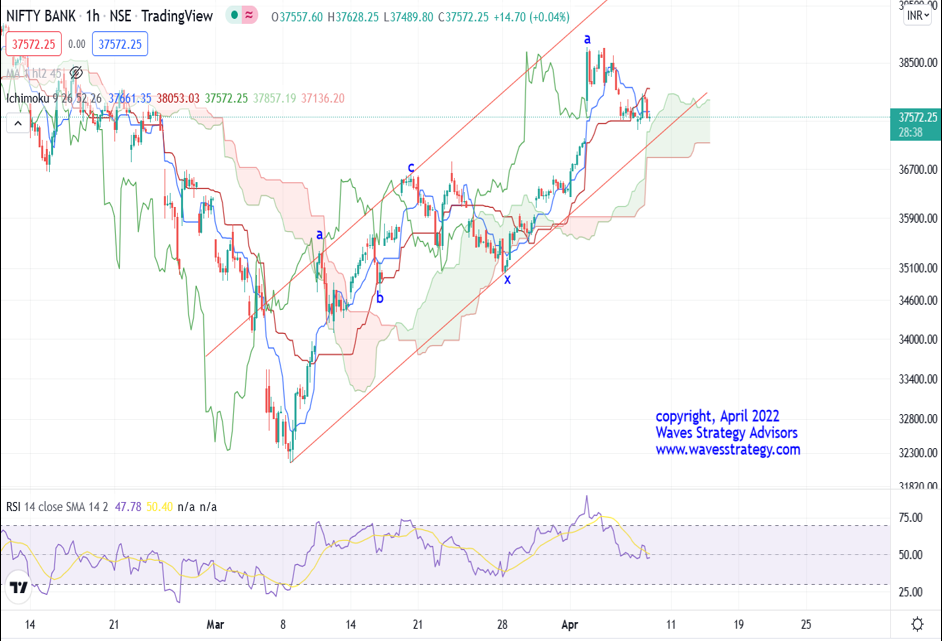

Below is the chart of Bank Nifty showing the Elliott wave pattern currently going on:

Bank Nifty hourly chart:

Elliott wave analysis: We can see that prices after forming a low near 32300 is rallying on upside in the form of double corrective pattern. Wave x completed near 35100 levels and sharp rise was seen towards 38600 levels in form of wave a. Now prices are moving in the form of wave b and so the fall is in overlapping fashion without any meaningful trend. Post completion of wave b we can see a leg up again in form of wave c. This is valid as long as low of wave x near 35100 is intact. With this information let us now combine Ichimoku Cloud

Ichimoku Cloud: In the current uptrend form the lows formed on 8th March 2022 prices have respected the Cloud (highlighted area). The cloud tends to provide support and acts as a zone from where there can be a possible reversal. This with Candlestick can provide classic trading opportunity or setup. We can see that the cloud support for Bank Nifty is near 36800 – 37400 levels. This is a thick cloud and so we are getting very broad range. This usually happens when there is not much of a distribution and sudden reversals. We now have to observe candlestick pattern and see if there is a possibility of a reversal that will hint towards completion of wave b and start of wave c higher.

In a nutshell, near term trend for Bank Nifty is negative with important support near 36800 levels. A positive reversal back above 38000 will suggest wave b is probably over and wave c higher is starting. This way one can trade in combination of Candlestick, Elliott wave and Ichimoku Cloud and form prudent Option Trading Strategy.

Become Market Wizard (BMW): Learn the science of Trading Options using simple Open Interest analysis along with Volume profile, Bollinger Bands in Option Trading Using Technical Analysis (OTTA) program on 23rd – 24th April 2022, combine this with GPS of the market – Elliott Wave, Neo wave and Time cycles and forecast it accurately in Master of Waves (MOW) scheduled on 28th – 29th May 2022, Early Birds ends on 15th April 2022. Fill the below form for more details: