Bank Nifty Surged 1200 Points – Here’s How We Saw It Coming

Jun 30, 2025

Neo wave along with a Time cycle together helps to form a powerful trade setup with good accuracy.

Using the power of Time cycle and Neo wave, we anticipated Bank Nifty's next move in our Aakash monthly report that was published on 20th June, 2025 — Check it out!

Take a look of how we anticipated a move to fresh record highs in Bank Nifty. Here is the detailed research:

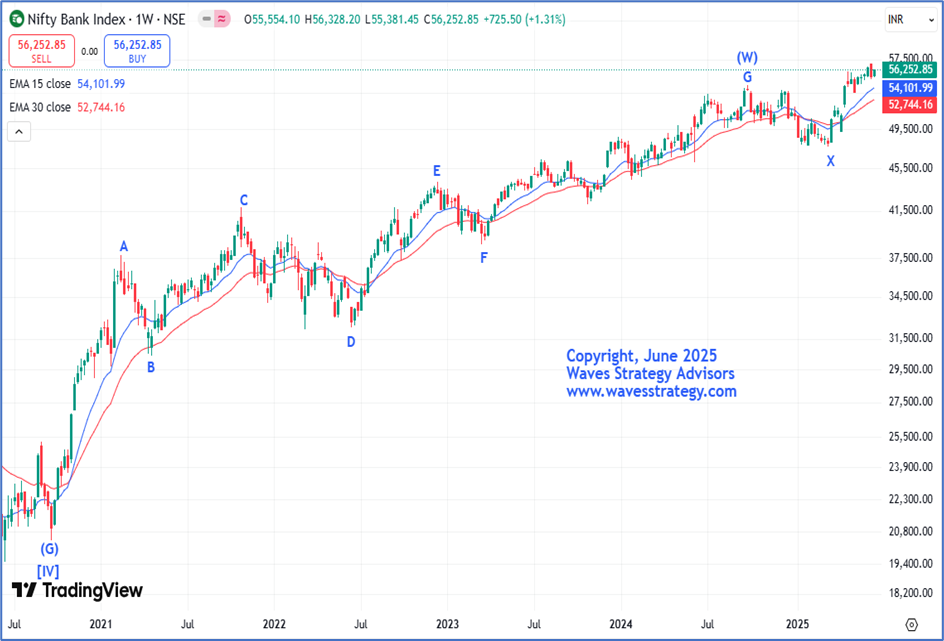

Bank Nifty Weekly chart with EMA: Anticipated as on 20th June 2025 Bank Nifty Daily chart with Neo wave and Time cycles: Anticipated as on 20th June 2025

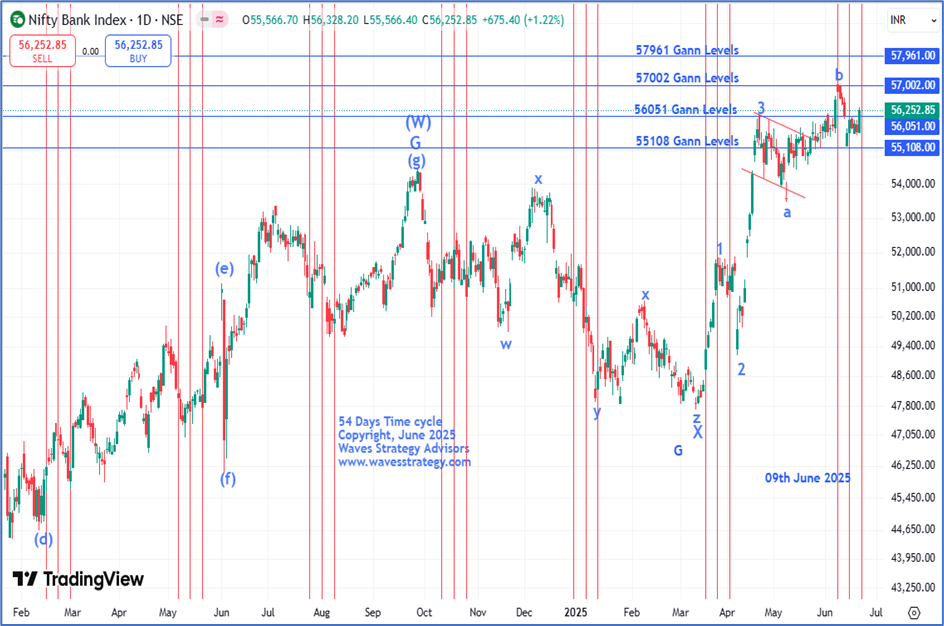

Bank Nifty Daily chart with Neo wave and Time cycles: Anticipated as on 20th June 2025 Anticipated wave Analysis as on 20th June 2025

Anticipated wave Analysis as on 20th June 2025

RBI Rate Cut – RBI cut the repo rate by 50 basis points from 6% to 5.5% marking the most pronounced rate cut since the Covid era. Along with this, a substantial 100 basis point reduction in the CRR provided the liquidity push which positively impacted the interest sensitive sector sectors with banking sectors stocks emerging as the key beneficiaries. This pushed the Index to break above its month-long consolidation of 56100 to 54170 levels to cross 57k territory.

Weekly Chart with EMA – As per the candlesticks, every candle since 12th May has managed to protect its prior weeks’ candle on closing basis which keeps the weekly bias on the side of the bulls. Also, we have applied 15 period EMA (Exponential Moving Average) and 30 period EMA (Exponential Moving Average) on the weekly chart. Since the bullish crossover happened in April 2025, Index has witnessed an exponential rise of nearly 8000 points from it which indicates that bulls have taken control of the weekly trend. Overall medium-term trend remains bullish unless we see a weekly close below prior candle’ low.

As per the price action, on 6th June 2025, Bank Nifty finally gave breakout of its month-long consolidation of 54170 to 56100 levels which was led by the rally in the Private sector banks and made a fresh high of 57049 levels. However, the Index was unable to sustain near above 57k mark and moved on the downside.

54 Days’ Time Cycle – Prices have already entered into its cycle zone which was due on 09th June 2025. A break above 57000 levels can turn cycle on the buy side which can result into an attempt making fresh highs. Until this happens overall consolidation is likely to continue.

Neo Wave perspective- Primary wave 3 got completed on the upside in April 2025. Post which the consolidation has been is in the form of wave 4 of Primary degree which is further subdividing in nature. Wherein, as wave b has retraced beyond the territory of wave a, so it opens up a possibility of an irregular flat pattern. Post completion of wave c of 4. Upside move can resume in form of wave 5.

In a nutshell, Bank Nifty is at important juncture. Amid escalating tensions between Iran and Israel volatility can be high so one must trade with strict stoploss. Acceptance above 56350 is required for up move to resume towards 57002 which is a Gann level followed by 57961 Gann levels, On the downside, 55100 levels is the nearest support to watch out for!

Bank Nifty Daily Chart: Happened as on 30th June 2025 Happened as on 30th June 2025

Happened as on 30th June 2025

In our monthly report, we expected Bank Nifty to achieve of Gann target level of 57002 levels followed by 57961 Gann levels. Bang on!

Prices broke above 56350 levels and surge by more than 1200 points and achieved our target 1 which is Gann target of 57002 levels in a short span of time. Time cycle is already turned on the buy side and in today’s session prices made a fresh high of 57614 levels.

We were able to predict this rise before it actually happened using Time cycle, wave theory and Gann square of 9. Now prices are heading towards our next Gann target of 57961. One can continue to use buy on dips approach unless we see a close below prior day’s low.

Sutra of Waves – (Elliott wave with Neo wave) live session on 12th 13th July 2025 – You cannot miss learning this science completely and equip with such powerful forecasting methods that actually work. Neo wave is ultimate step towards trading successfully and missing element in your trade cycle. Limited seats only,

Trishul membership consists of Options Mantra, Elliott wave, Sutra of Wave. Fill below form for more details: