Is Bank Nifty moving in sync with Neo Wave?

Jul 11, 2025

Neo wave is the GPS of the market that helps to understand the overall maturity of the trend. Neo wave is an Advanced Elliott wave that provides forecasting ability. It is a method that is used to identify price pattern and predict market movements.

Read the below article, where Bank Nifty has been moving precisely as per our Neo wave counts.

Bank Nifty Daily Chart  Bank Nifty Hourly Chart

Bank Nifty Hourly Chart Bank Nifty has been in sync with our Neo wave counts. On the daily chart, Bank nifty is currently stuck in between a broader range of 56600 to 57630 levels. Recently, the Index post making a fresh high of 57628 levels reversed on the downside and now is trading near its mid Bollinger bands® which is sign of weakness. For now, a daily close below it can further extend this down move. As per the wave theory, the entire rise since March 2025, has been impulse in nature. Wherein, wave 4 of Primary degree got completed on the downside in the form of a complex correction pattern (w-x-y) in June 2025 and the current rise is in the form of wave 5.

Bank Nifty has been in sync with our Neo wave counts. On the daily chart, Bank nifty is currently stuck in between a broader range of 56600 to 57630 levels. Recently, the Index post making a fresh high of 57628 levels reversed on the downside and now is trading near its mid Bollinger bands® which is sign of weakness. For now, a daily close below it can further extend this down move. As per the wave theory, the entire rise since March 2025, has been impulse in nature. Wherein, wave 4 of Primary degree got completed on the downside in the form of a complex correction pattern (w-x-y) in June 2025 and the current rise is in the form of wave 5.

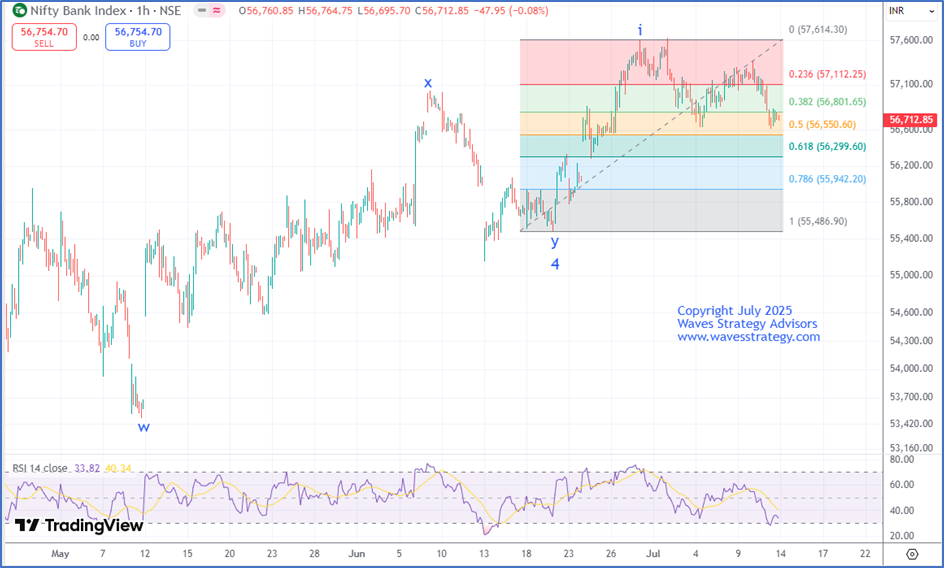

On the hourly chart, the ongoing Primary wave 5 is further subdividing in nature. Wherein, internal wave i recently got competed on the upside and the current fall is unfolding in the form of wave ii. As per the Neo wave rules, wave ii can only retrace up to 61.8% of wave i and now a break below its previous swing low of 56620 levels can further retrace prices towards 61.8% that derives the target of 56300 levels on the downside. However, if price manages to give a decisive break below the said level, it can invalidate the entire wave count.

For such Bank Nifty levels and strategic insights, join our Prithvi Membership where you get expert analysis and actionable levels. Click here

Sutra of Waves (SOW) – Elliott wave has a few rules making it subjective at times but Neo wave has more rules and newer patterns like complex correction, Diametric, extracting triangle, that makes trading a lot more objective. Combine this with price action and Fibonacci trading system and see the magic of systematic trading using this scientific approach of trading. Limited seats only, Live session on 12th – 13th July. Fill out the form below to know more.