How to catch a BIG move using a simple chart pattern with Indicator

Sep 23, 2022

Like this Article? Share it with your friends!

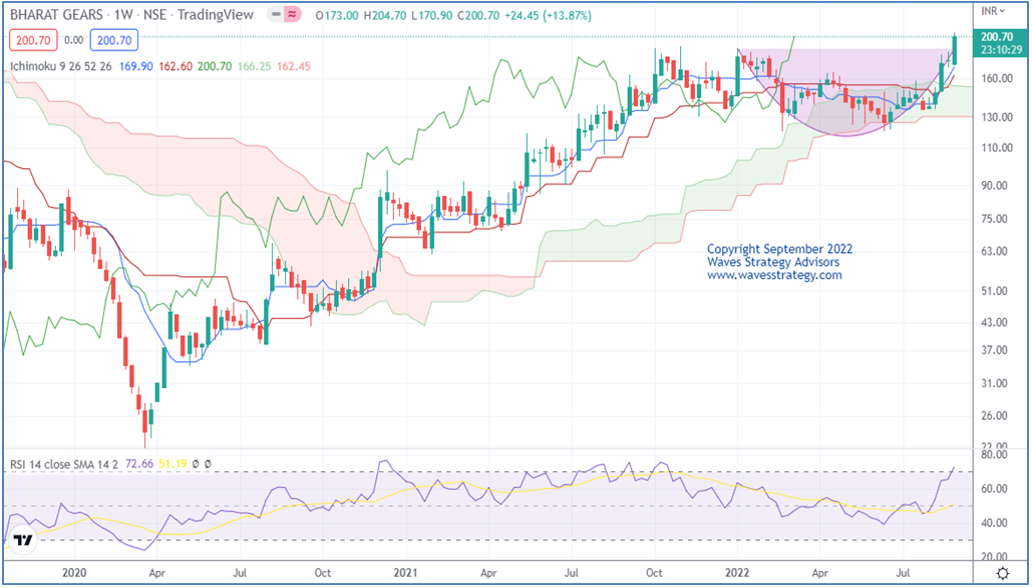

BHARATGEAR: Combining Rounding Bottom with Ichimoku cloud

While trading the market it is important to understand the behaviour of the market. Using price action along with indicators like Ichimoku clouds we can predict price moves in stock with high accuracy. Check out how we recently identified one such breakout in BHARATGEAR

We published the BHARATGEAR analysis in "The Financial Waves Short Term Update" on 2nd September which our subscribers receive pre-market every day. Check out below the detailed research report that we published.

BHARATGEAR Weekly chart as on 2nd September 2022: (Anticipated)

BHARATGEAR Weekly chart as on 23rd September 2022: (Happened)

Wave analysis as on 2nd September 2022:

On the weekly chart, in the previous session prices formed a bullish candle. A weekly close above 189 which confirm breakout of rounding bottom pattern. Price has recently bounced from the ichimoku cloud which can act as near-term support zone.

In short, trend for this stock is positive. Use dips towards 195-197 as buying opportunity for a move towards 215-220 levels as long as 188 holds on the downside.

Happened:

The stock moved as we expected. BHARATGEAR have given breakout of rounding bottom with huge volume which was a bullish sign. Within 15 trading sessions, the stock has achieved our target and made high of 258.95 which is more than 32% within a short span of time.

Free Week is Here - Access Free Equity research report with complete Elliottwave counts, Stocks, Charts Nifty outlook free until 27th September. Download the App now and Check the Study material section Here is the link to download

For IOS users Download the App My Institute use Org Code "esiad"

3 Months of Mentorship on Timing the Markets starts in November 2022 – Trade along with me for a period of 3 Months by practically applying the concepts on Time, Stock selection, Algo creation, Complete hand holding, Option trade setups, risk and money management, right from the very basics to the essence of time. For more details check here