Want to Catch the Next Eternal Ltd Move? Learn How We Did This

Jul 23, 2025

Elliott wave when combined with Price action leads to interesting results. By using Time cycle and wave theory together it can help predict capture reversals way before it has happened.

New traders want to trade and capture every moves & on other hand seasoned ones know the real money lies in sitting tight and try to capture the best of the 3rd wave.

See the detailed analysis on Eternal Ltd that we published in our Aakash monthly report on 22nd April 2025.

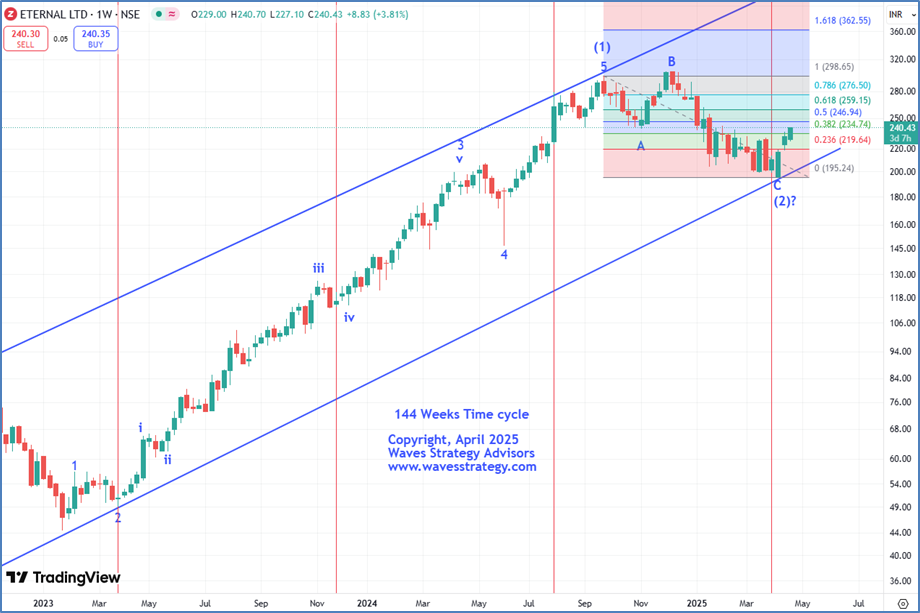

Eternal Ltd Weekly chart with Time Cycle: Anticipated as on 22nd April 2025 Eternal Ltd Daily chart with Wave Theory: Anticipated as on 22nd April 2025

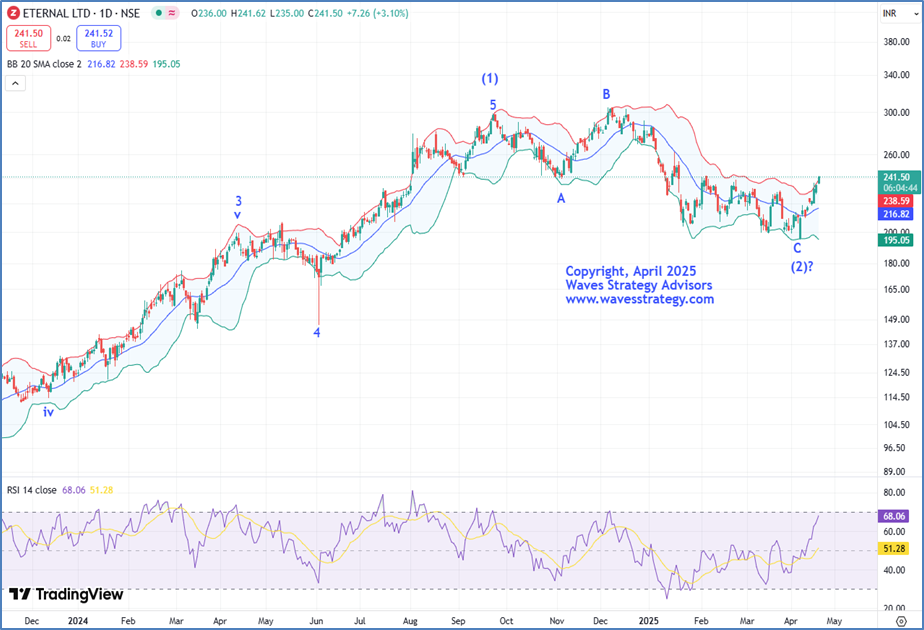

Eternal Ltd Daily chart with Wave Theory: Anticipated as on 22nd April 2025 Anticipated wave Analysis as on 22nd April 2025

Anticipated wave Analysis as on 22nd April 2025

Eternal Ltd is the newest entrant in Nifty 50. The stock has been moving within a multiyear channel since July 2022 signifying strong trend in the stock. Now let’s understand the view for Eternal with the help of advanced technical tools.

The stock is following classic Elliott wave theory. Wherein, Primary wave (1) recently got completed on the upside in September 2024 and since the entire fall has been unfolding in the form of wave (2) which is further subdividing in nature. Wherein, it looks to be unfolding in the form of an irregular flat pattern (3-3-5) as wave b has retraced more than 100% of wave a. For now, a decisive break above 245 levels can confirm completion of wave (2) on the downside. Then the rise would be in the form of primary wave (3). As per the Elliott wave guidelines, it is considered to be the strongest wave.

Weekly chart- Prices recently found support of its multiyear channel and reversed on the upside which is positive sign. In the previous week, price has closed above prior candle’s high which is giving us hints about possible trend change on the sides of bulls. However, for confirmation acceptance above 246 is must. Also, prices have retraced more than 38.2% of the prior fall and now with follow up buying we can expect prices to retrace minimum to 61.8% i.e. 259 levels.

On the daily chart, we have applied Bollinger bands® to gauge price action and volatility in the stock. Since reversing from the lower Bollinger Bands® on April 7th, the stock has consistently protected its prior day's low on closing basis suggests that bulls are tightening their grip by each day passing. As prices have managed to complete its journey towards the upper bands which reinforces strength in the ongoing trend.

144 Weeks’ Time Cycle – Time cycles are another amazing technique which helps in capturing lows and highs from time to time. Every stock has its own Time cycle and here on the Weekly chart, we are showing 144 Weeks’ Time cycle, it is really effective in capturing the major low points. Currently, prices have already entered into its cycle zone which was due on 1st April and has formed a short-term low near 194 levels. For now, we expect prices to break above 245 levels can confirm that cycle has turned on the buy side.

In a nutshell, the current trend for Eternal looks to be bullish. A break above 245 levels is must for bullish momentum to continue which can lift the prices higher towards 285 and eventually to 320 levels. On the downside, a break below 210 levels which is a channel support will be a sign of trend change.

Eternal Ltd Daily Chart: Happened as on 23rd July 2025 Happened as on 23rd July 2025

Happened as on 23rd July 2025

In our monthly report, we expected Eternal Ltd to show an impulse rise as we anticipated wave 3 of Primary wave to start on the upside which is considered as the most trending wave as per the guidelines. On 21st July 2025, the company announced better than expected quarterly results which pushed prices towards its lifetime high of 311 levels.

Prices broke above 245 levels and saw an exponential rise of nearly 27% since. This helped prices to surge through our target 1 of 285 levels and nearly achieved our target 2 of 320 levels. We were able to predict this rise before it actually happened using Time cycle, Wave theory and Price action.

Brahmastra (Mentorship) on Timing the market – Equip yourself with tools of Elliott wave, Neo wave, Time cycle, stock selection algo creation, Multibagger and momentum stocks identification along with exact trade setup that actually works. Fill below form for more details.