Just Dial: Down by 7%, Was This Move Predictable?

Feb 03, 2020Just dial has been forming lower lows and lower highs from consecutive 6 days indicating down trend as per simple bar technique. Also by simple channeling technique prices were placed near channel support and break of it was a sign of selling emerging.

Look at the below chart of Just Dial published in the equity research report on 01st February morning before markets opened – The Financial Waves short term update

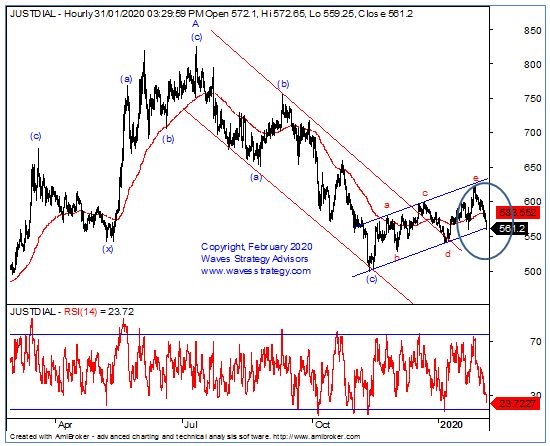

Just Dial hourly chart: (Anticipated as on 1st February 2020)

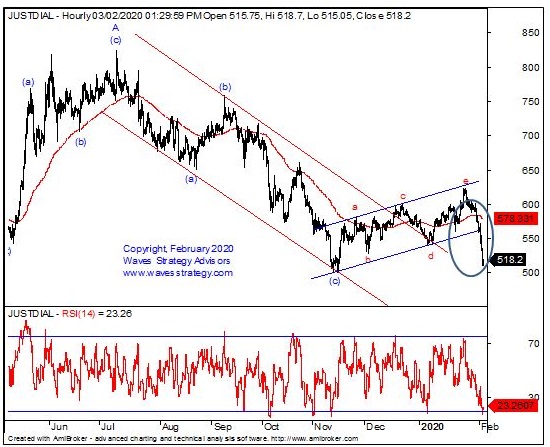

Just Dial hourly chart: (Happened as on 03rd February 2020)

Wave analysis: Following was mentioned on 01st February when the stock was near 561 levels.

On the daily time frame, the stock is precisely moving within the blue channel in the form of wave (x) which seems to be forming Diametric pattern or triangle and currently prices are placed near the crucial channel support trendline. We have shown Fibonacci retracement of wave (c) prices have reverse on downside post retracing up to 50%. Now it is crucial to see whether prices break below or bounce off from the channel support.

On hourly chart, prices are moving in an overlapping fashion. As long as we do not see any break above the moving average on closing basis we continue to move lower and break below the channel in the form of wave f on downside. However if we see bounce off from the channel we might terminate wave f near the lower trendline and wave g might have begun on upside. Prices are yet to confirm the above scenario.

In short, Just Dial seems to be at crucial point as of now. Break below 550 levels can allow prices to move lower towards 530 or lower levels as long as 600 levels stays intact on upside.

Happened: The stock performed precisely as expected and has given classic channel support breakout in just one single day, made its intraday low near 500 levels.

I will be starting 3 months mentorship from February 2020. Intention is to give away everything I have learned over decades that a trader should know. Discipline and application is the key for success as a trader. I will be taking only a few candidates. Register here

Do not have time to track the markets. Get access to the daily advisory calls on Equity, Commodity, Forex markets directly via sms or whatsapp. Know more here