Kotak Bank: How to identify Multibagger Stocks

Nov 11, 2020Kotak Bank had been a strong outperformer within the banking space and the stock has made a new 52 week high near 1806 in today’s session. The stock was forming higher high and higher low since past 4 weeks indicating positive momentum building up. It is one such stock that we recommended in our Multibagger research report based on various studies like Elliott wave, indicators.

See below how Kotak bank performed that we recommended a year ago. .

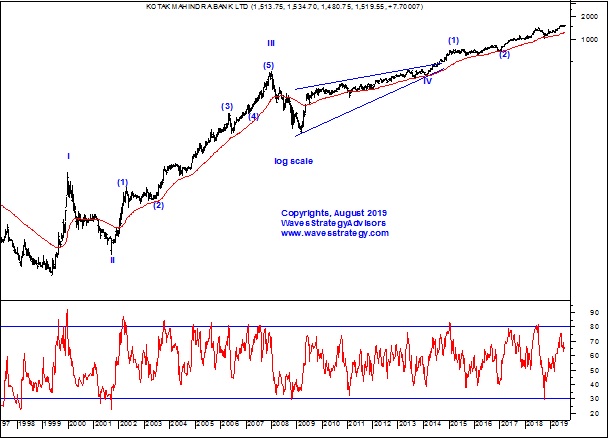

Kotak Mahindra Bank Weekly chart:

Kotak Mahindra Bank Weekly chart: (Happened to till now)

(Following research is taken from Multibagger report published on 07th August 2019)

Multibagger stock recommendation: Kotak Mahindra Bank

Buy Price – Buy at CMP 1486 and more on dips to 1300

Time Horizon –2 to 3 years

Investment – 5% of capital

Target price – Given in actual Report

Stop loss – ???

Anticipated as on 07th August 2019–

Elliott wave pattern: There is a clear impulse rise as shown on the weekly chart and the stock is currently moving in form of wave (3) of V. As wave IV was drifting higher there is a possibility that wave (3) of V might travel towards 261.8% of wave (1) of V. Even if we see wave (4) early on then the projected target, still there will be room for wave (5) to move higher towards the target zone eventually. We do not rule out short term dips given the weakness in broader market and next 6 months can be tricky.

It is best to buy the stocks in staggered fashion on dips slowly and steadily so that there is scope for averaging at lower levels looking at the overall correction in the broader and global markets. Also time horizon has to be increased as the scenario over next 6 months can be challenging.

These are fundamentally strong companies and should be there is the portfolio so that as and when the cycle turns on upside these will be leading the rally.

In a nutshell, one can buy Kotak Mahindra Bank at CMP 1486 and more on dips to 1300 levels. One can maintain a stop of …. levels which is near the high of wave (2) of V for the target of …. or higher once the overall cycle turns up!

P.S- Levels are hidden purposely. Kindly use this research for study purpose only.

Happened as of now – The stock has been moving in sync with our expectation. It has touched its new 52 week high near 1806 levels in today’s session. The up move has been strong and we expect prices to achieve its target of …..levels in coming months. The stock is giving a return in excess of 30% from the high made over the years’ time

The above analysis clearly shows how one can identify the stocks from positional investment perspective just with the help of Elliott wave, time cycles and other advanced indicators.

If you wish to build portfolio of stocks that can be a potential Multibagger we can help you with identifying the stocks which can give alpha returns over medium to long term holding period. Get access here

Even in such elevated markets, want to know which stocks to pick up which gives better returns over the period of one year, this DIWALI. Get 4 stocks which are sector based outperformer. Subscribe to our this year Diwali Picks

Join me for the 3 months of Mentorship on Technical analysis starting from 21st November 2020. It is important to understand how everything in connected together whether it is a fundamental or a technical parameter. I will be sharing more than decades of experience over the period and ensure you become a much better trader. There will be Q&A sessions and discussions ongoing post mentorship as well. So it is a long term association and commitment from my end to make you a wonderful Trader. Hurry up!. Fill the form here