Momentum stock Tata Motors: Target Achieved in 4 days, with 11% returns

Jun 03, 2020Nifty crossing 10000 mark one of the psychological level posts the down fall. Given the momentum in the index identifying sectors driven stocks and gaining returns is one thing to do at this time.

Given the upward momentum we capitalized on stocks which were ideal to trade for 10% – 12% returns in this index favourable rally.

Along with Nifty index, Auto sector looks to have reversed on upside. Tata Motors is one of the stock that could contribute on higher side as Elliott wave count also shows indication on upside and also don’t forget to check the amazing channels.

We generated buy call under Momentum Service on Tata Motors on 27th May 2020 and we achieved out target level as our studies showed.

See below what did the chart suggests:

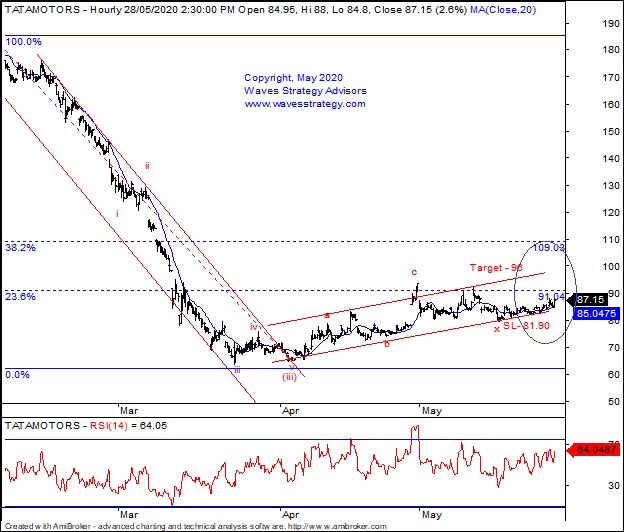

Tata Motors hourly chart: Momentum call given on 27th May 2020

Tata Motors hourly chart happened on 02nd June 2020

(Following research is taken from Momentum report published on 28th May 2020)

Elliott wave analysis:

Momentum stock recommendation: Tata Motors

Buy Price – Buy above 86.50

Time Horizon –Not Applicable

Investment – 5% of capital

Target price –96

Partial Profit: 91

Stop loss–81.90

On the hourly chart of Tata motors, internal counts suggests that wave a seems to be unfolding on upside. We expect prices to move towards upper trendline of the channel near our target level of 96.

Also Fibonacci retracement shows one can book partial profits near 91 levels which coincide with 23.6% of preceding wave to ensure minimizing risk. On lower side, 81.90 levels can be ideal and important stop loss as its near channel support and also near the wave x.

In short, trend for Tata motors looks to be positive. Break above 86.50 will take prices higher towards 96 levels or probably even higher. This outlook is valid as long as 81.90 is protected on down side. Also ensure to book partial profits near 91 levels and trail stop to cost so that the risk is minimized.

Happened: The stock rallied more than 11% in just three trading sessions and we achieved our target of 96 levels reaching exactly near upper channel trendline. It simply shows power of Elliott wave patterns that we use for most of our research. Currently the stock is trading as 100 levels in upward direction.

Momentum calls: During such times it is important to capitalize by buying the stocks that can show momentum along with broader market. Always remember not every stock will move the way we expect but it is important to maintain strict stoploss as these are high risk trades but with potential to give the max gain in shortest possible time. Get access now as the momentum starts building UP.

Mentorship – Learn and equip yourself with tools necessary to identify such classic trading opportunities with precision of time. 3 months of Mentorship will focus on how to apply these methods along with trend following techniques and risk management, money management. Do not wait for markets to challenge you emotionally and financially every now and then but trust me your anxiety levels will reduce sharply once you know how the trade is going to move. Only a few seats left for June 2020. Know more here