Multibagger Britannia:22% returnsin just 6 Months

Jan 16, 2020In a portfolio not all stocks will contribute at the same time as we recommend from different sectors and stock movement is cyclical. But it is best to keep buying the ones that are exhibiting impulsive trend.

See below how Britannia performed that we recommended just 6 months ago.

Britannia had been in secular bull trend for more than two decades. The stock has given exponential returns and even in the recent correction it has managed to move sideways with minor correction.Britannia is one such stock that we recommended in our Multibagger research report based on various studies like Time cycles, Elliott wave, indicators.

We recommended this stock when it was quoting near the 2950 levels and was successfully able to catch the upmove. See yourself how we were able to catch the upmove even before it began.

Below is the chart showing detailed analysis published in our research report –“The Financial Waves Multibagger Update”

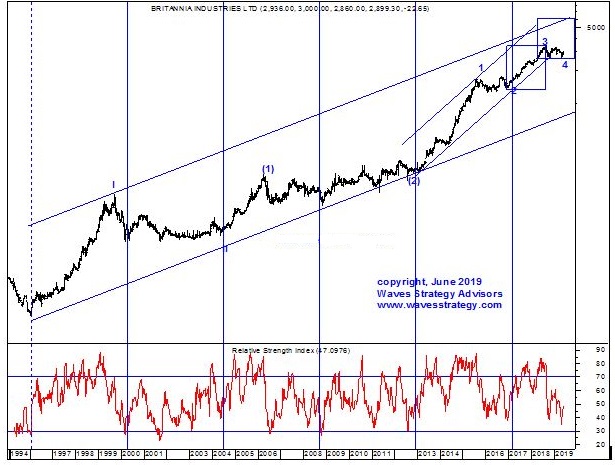

Britannia Weekly chart: (Anticipated as on 10TH June 2019)

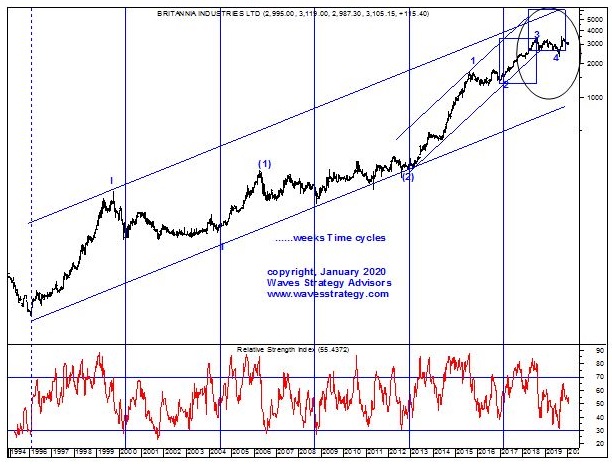

Britannia Weekly chart: (Happened as on 16th January 2020)

(Following research is taken from Multibagger report published on 10thJune 2019)

Multibagger stock recommendation: Britannia

Buy Price – Buy at CMP 2950 and more on dips to 2600

Time Horizon –2 to 3 years

Investment – 5% of capital

Target price – given in actual report

Stop loss – ???

Anticipated as on 10thJune 2019– As shown on the weekly chart, the stock is now moving in wave (3) of III. Time cycles have worked out very well and the stock has bottomed out every ….weeks. Within this uptrend we are seeing wave 4 currently ongoing in the form of a Flat or a triangle pattern and post its completion wave 5 on upside should start taking prices towards …..levels eventually.

Given the expensive reading on Nifty as of now it is better to buy the stock in staggered fashion and not everything at one go.

In a nutshell, as the stock is in secular bull trend it can be entered at current price near 2950 and more on dips to 2600 levels. One can keep a stop loss of …..which is near the wave 1 area. Move towards this will result into overlap. On upside we can expect prices to move towards ….which comes near the upper end of the channel and also wave 5 projections to equality with wave 3 on log basis. However, one might need to extend the time horizon given the expensive territory in which Nifty is trading which can lead to systematic risk. It is best to accumulate this stock on declines in slow and steady manner.

Happened as on16th January 2020 – The stock has been moving in sync with our expectation and currently quoting near 3151 levels. It has touched its new lifetime high near 3583 levels in the month of September 2019. The upmove has been strong and we expect pricesto achieve its target of …..levels in coming months. The stock is giving a return in excess of 22% in just 6 months of timewhen

Multibagger portfolio –Create your portfolio of Multibagger stocks and you can simply see power of impulse up. It took only two days for stocks to recover and move sharply higher. Months of correction has been retraced back in less than 2 days.

The above analysis clearly shows how one can identify the stocks from positional investment perspective just with the help of Elliott wave, time cycles and other advanced indicators. If you wish to build portfolio of stocks that can be potential Multibagger we can help you with identifying the stocks which can give alpha returns over medium to long term holding period. Get access now