Nifty Trading using Neo wave: Is it Time to Buy or Sell?

Dec 29, 2022

Like this Article? Share it with your friends!

Elliott wave and Neo wave are powerful technical analysis methods that can help traders with the complete setup right from Intraday to positional trades.

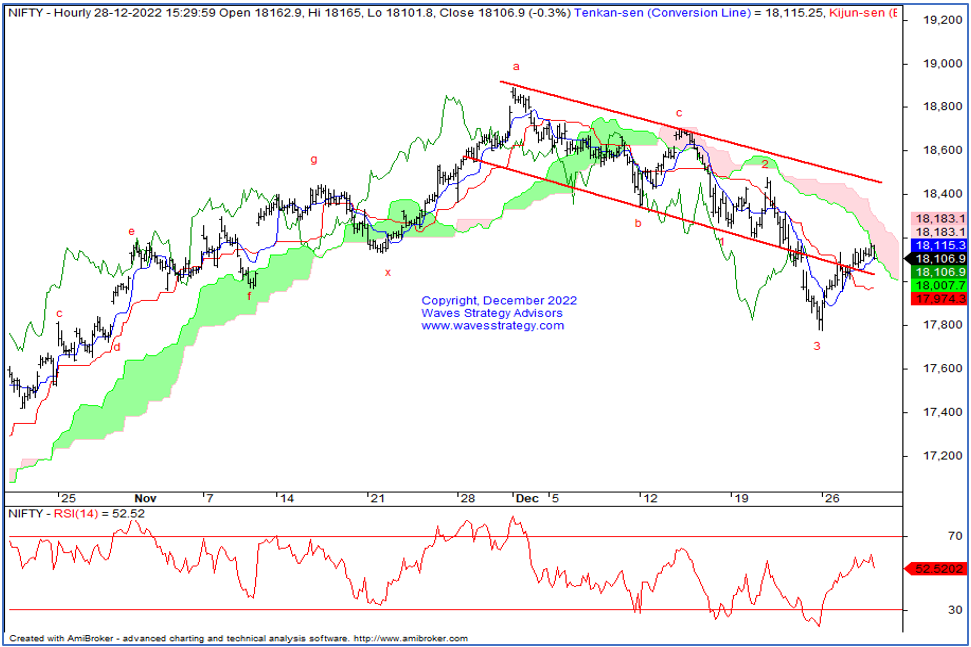

Below shows Nifty Neo wave count along with Ichimoku Cloud. This research is picked up from the daily Equity research report “The Financial Waves short term update”

Nifty 60 mins chart

In the previous session, Nifty opened on a negative note and witnessed consolidation. During the day sideways action was seen which led prices to end on a flat note with a minor loss of -0.05%.

From medium term perspective, any break above 18200 can lift prices higher towards 18400. Whereas any move below 17880 can accelerate further selling pressure. Also, today is the weekly expiry as well as the last expiry of the year so volatility is expected.

On the hourly chart, Nifty looks to be stuck in a range of 18000-18200. After 2 days of rally, Nifty looks to be in a mood of a consolidation phase. Any break of mentioned range can help us to clear the bigger picture. As per wave perspective, wave 4 is unfolding on the upside which has retraced 50% of wave 3. As per OI data, 18000 strike has the highest OI on the put side. Whereas, 18200 strike has the highest OI on the call side. This suggests that crossing above levels is not going to be easy.

In a nutshell, Nifty looks to be stuck in a range of 18000-18200. Any move above 18200 can continue bullish momentum on the upside. Whereas move below 18000 will turn sentiments on a negative side.

Be a part of Master of Waves on the 7th and 8th of January which will focus on the Elliott wave, Neo wave, Hurst’s Time cycles, and also a special section on Trading using Gann square of 9. Be a part of this Elite Trading Community #wavetraders. Limited seats. Fill the form here for more details