Nifty 3 Indicators Cannot Be Ignored! Ichimoku Cloud, Elliott Wave and RSI

Mar 24, 2021

Nifty 3 Indicators Cannot Be Ignored! Ichimoku Cloud, Elliott Wave and RSI

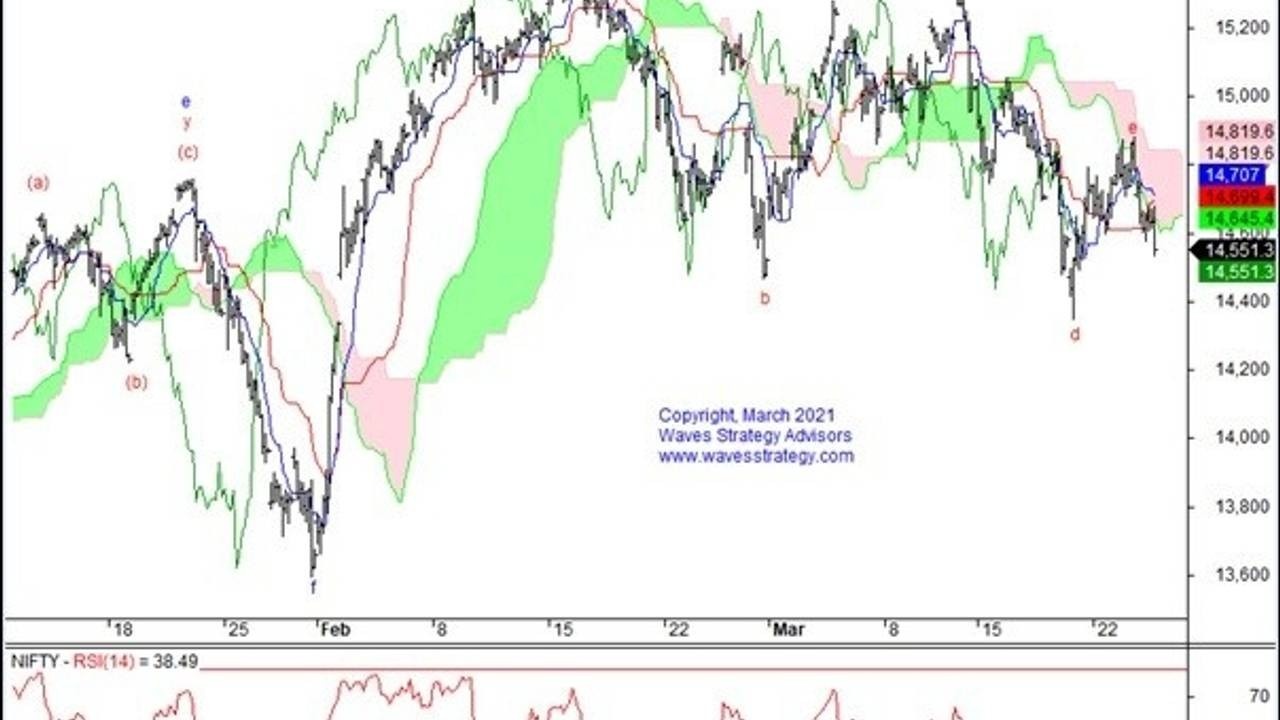

Nifty had shown sharp fall today and prices reversed exactly from the hourly Ichimoku Cloud and possibly completing wave e of the ongoing Triangle pattern.

Below is the chart shown in the morning in “The Financial Waves short term update” that contained detail outlook on index and 3 stocks on basis of important indicators and Elliott Wave, Neo Wave techniques.

Nifty 60 mins chart

3 Important Indicators that suggesting something major might start –

Neo Wave – advanced Elliott Wave concepts are suggesting that prices might have completed the entire triangle pattern and breach below the support levels of 14350 will further confirm that the medium term trend is reversing back on downside. On upside close above 14800 is going to act as major hurdle.

Ichimoku Cloud – This is simple yet powerful indicator that provides clear trending direction, support and resistance levels to prices. We can see from above chart, red cloud acted as stiff resistance and prices reversed back from there breaking below both the blue (conversion line) and red (base line) as well.

Relative Strength Index (RSI) – This indicator on hourly chart has failed to show any move above 60 levels. This usually happens when we are in a downtrend. Also this is not oversold yet which is below 20 zone that indicates there is more room that prices can cover.

However, do remember that any trade has to be taken with strict stoploss and there can be equally fast reversals. So risk and money management becomes extremely crucial. The above are 3 Indicators that you cannot ignore before taking a trade and all are in sync so far! Time to be alert and ride the trend!!!

Get access to the daily research report “The Financial Waves short term update” and advisory calls on stocks, Nifty, Bank Nifty over here

Become Market Wizard Season 2 (BMW) – From basics to the advanced levels of Technical analysis will be covered in Master of Technical Analysis (MOTA Season 2) and Master of Waves (MOW Season 2). Many indicators along with Option writing strategies will be discussed in this season of BMW program. Make the most of the Early Bird offer – know more over here