Nifty Andrew’s Pitchfork cannot be Ignored

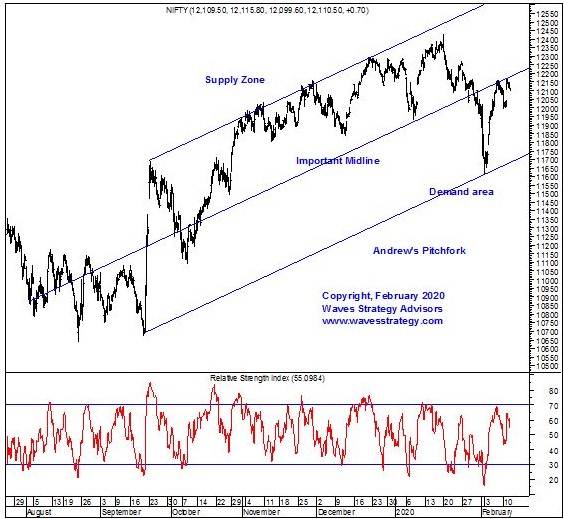

Feb 11, 2020Nifty had been all over the place over past few weeks but this one simple tool – Andrew’s Pitchfork has worked out amazingly well.

September 2020 low and top had been the most important period which has governed all the price action so far. Connecting these tops and bottoms with the Andrew’s Pitchfork provides vital information.

Nifty hourly chart:

Andrew’s Pitchfork works as a channelling technique but is based two trendline and median line. It has worked amazingly well in identifying the low made on the Budget day. The chart needs little explanation and it clearly suggests the important Demand and the Supply zone. The midline acts as either support or resistance depending on whether prices are above the same or below it.

Nifty has now reached back towards this mid trendline and so it is time to get ready to pull the trigger. In case of decisive break above the trendline the rally will extend further. The target levels will be given in the daily research report – The Financial Waves short term update.

On downside any break below 11990 will suggest that the rally has halted and we are reversing back on downside.

So, Nifty is at make it or break it scenario. Where do you think we are headed from here?

Get access to the daily research report “ The Financial Waves short term update” and see the crucial levels that you have to keep a track for forming trading strategy. Get access here

Do not have time to understand these things but need to get daily trading ideas on WhatsApp or SMS. Subscribe to the Nifty / Bank Nifty / Stock trading ideas and get research reports free along with it. Simply subscribe here