Nifty Gann Square of 9: Powerful Forecasting

Jan 08, 2026

Nifty has been drifting lower over the last three trading sessions. Prices have consistently failed to close above the previous day’s high, keeping the short-term bias tilted toward the downside.

To analyze this phase, we apply the Nifty Gann Square of 9 forecasting method, one of the most powerful techniques developed by W.D. Gann to identify crucial support, resistance, and magnetic price levels.

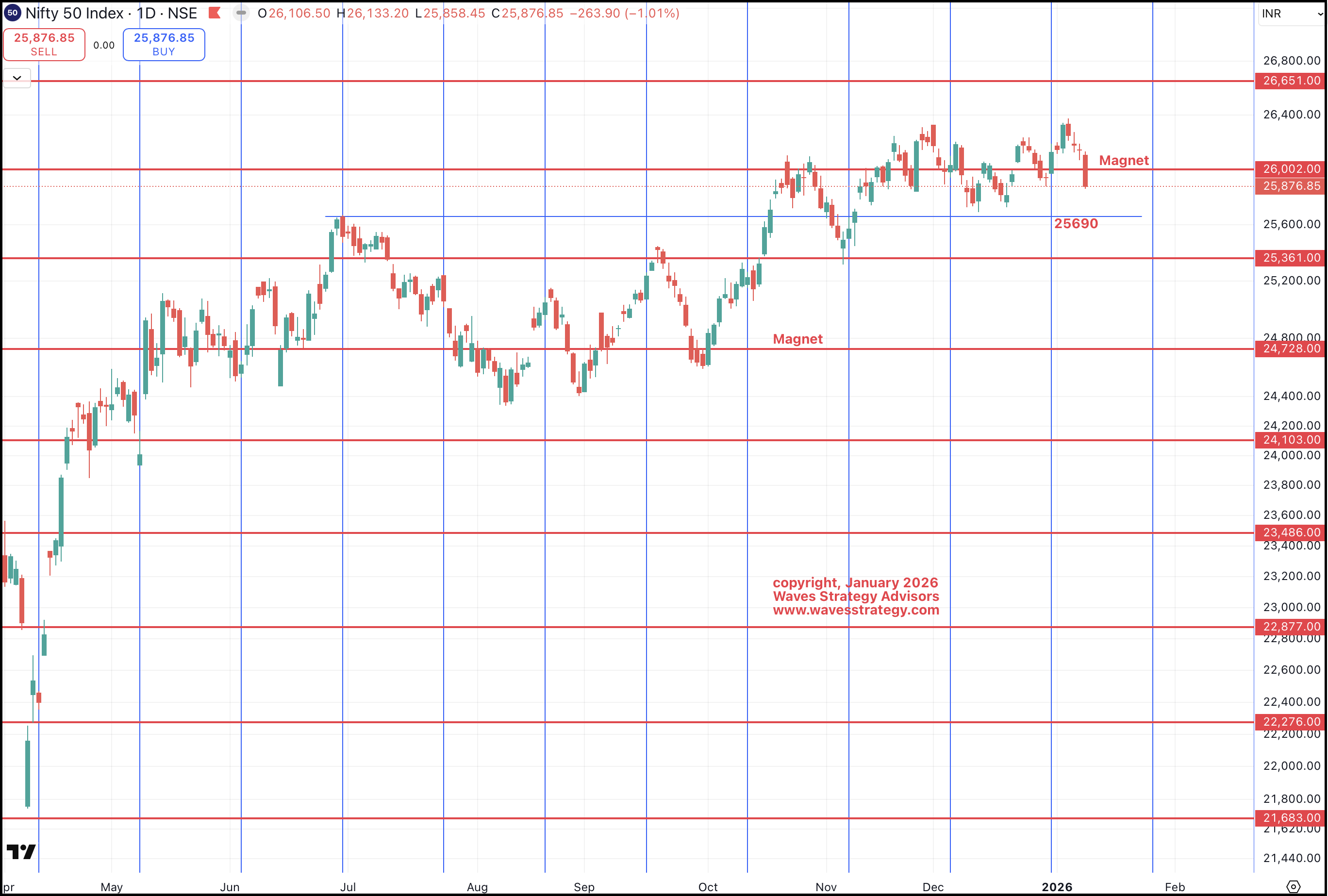

Nifty Daily Chart – Gann Square of 9 Forecasting

Gann Square of 9 Magnetic Levels

The Gann Square of 9 works on the principle that price moves in mathematical harmony. Certain price levels act as magnets, attracting price and causing repeated oscillations until they are decisively broken.

As highlighted in earlier analysis, the Gann magnet level of 24,728 worked exceptionally well, with Nifty oscillating around this zone for an extended period.

How Price Responded to Gann Levels

-

Price broke above the 25,361 Gann level

-

Nifty then rallied and started oscillating near 26,002

-

26,002 has emerged as a strong Gann magnet, clearly visible through repeated upside and downside swings

Magnetic levels often restrict directional movement until price builds enough strength to break away decisively.

Gann Square of 9: Magnetic Levels in Action

As mentioned a few months back, the Gann Magnet level of 24,728 was working extremely well, with prices oscillating repeatedly around this zone.

Subsequently:

- Prices broke above the 25,361 Gann Level

- Nifty then moved higher and started oscillating around 26,002

26,002 is now acting as a strong magnetic level, and we can clearly observe both upside and downside oscillations around this price.

Crucial Support Levels as per Gann Square of 9

- Immediate downside support comes at 25,690

- This level is supported not only by the Gann Square of 9 method

- But also by strong price action support

- If this same is broken, then the next major Gann Level at 25,361 opens up

Until 25,690 breaks decisively, we can expect range-bound movement to continue.

Upside Levels to Watch Closely

- A decisive break above 26080 - 26,300 is mandatory

- Only then does the next upside Gann Level of 26,651 open up

Magnetic Gann Levels restrict price movement, preventing sharp directional moves until the magnet is decisively broken.

Time Cycle Confluence Adds Strength

This analysis becomes even more powerful when combined with time cycle analysis.

- As per the 55-day time cycle, time support also lies near 25,690

- This creates a strong price + time confluence zone

Nifty is currently at a crucial juncture, with 25,690 emerging as a very important support level.

Short-Term Outlook

- On the upside, a move back above 26,080 is required in the short term positivity.

- Breach below 25880 can drift prices lower but Gann magnet of 26002 can keep pulling it.

- This can lead to another positive attempt on the upside

However, to break a Gann Level Magnet, one must wait patiently.

The bigger the consolidation, the stronger the eventual breakout move.

Final Takeaway

In a nutshell, the Gann Square of 9 Forecasting Method, when combined with time cycles, is an extremely powerful trading approach.

- It enables traders to time the market

- Down to the day, hour, and even minute

- Nifty remains at a decisive inflection point

- Traders can plan trades based on the above-mentioned levels

Brahmastra Mentorship: Timing the Market with Precision

Brahmastra Mentorship on Timing the Market is designed to create time traders who can accurately time the markets using advanced forecasting tools such as:

- GANN Forecasting Tools

- Hurst’s Time Cycles

- Elliott Wave

- Neo Wave

- Stock Selection Algorithm

- Complete hand-holding and guided learning

Do not miss this opportunity

Limited seats only

Early bird offer ends on 10th January

Fill the form below for more details