Nifty Lunar Cycle and Options Trading!

Apr 11, 2022

Nifty is following Lunar or Moon cycles extremely well. By understanding the Time along with Elliott wave can help in forming prudent Option strategy.

We have discussed this over the weekend free webinar on why this week can be a consolidation rather than trending. Majority turned super bullish after the rally in markets on RBI policy day but still there is not a single close above the previous day’s high so far. This one simple method of Candlestick can help form amazing trade setup.

Below is the Lunar cycle chart and option strategy:

Lunar analysis – We can clearly see that prices have been falling post the full moon which is highlighted circle below the prices until recently. This time prices rallied above from the full moon day and correcting after a day later from new moon on no moon. It is similar to behaviour we have seen before the top at 18600. Let us see if the similar action repeats again where we see a rally after full moon and a correction after new moon.

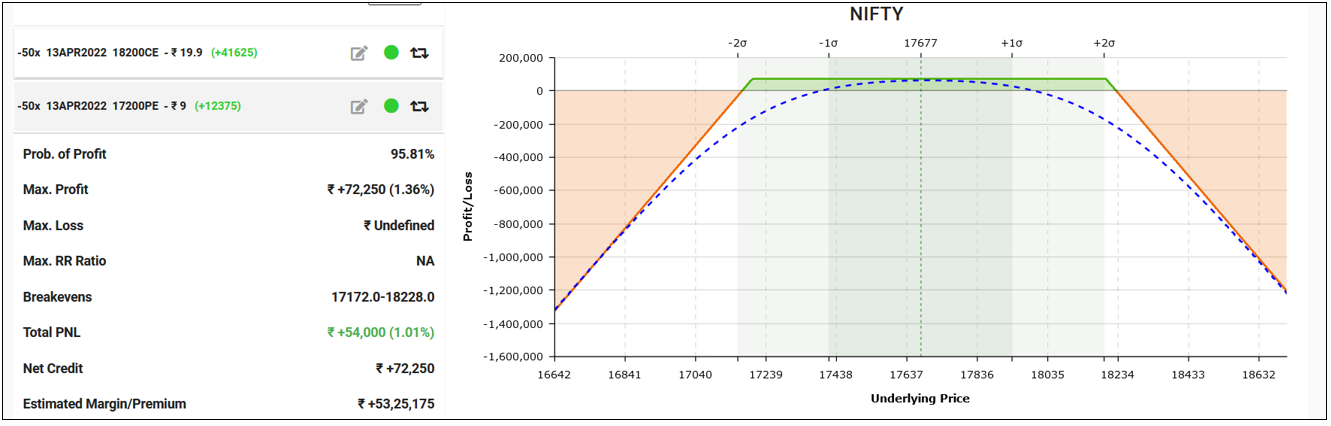

Now based on this information about Time cycles and market behaviour Options can be used to leverage and form classic strategy. Selling Strangle for out of money options is one of the ways to trade when we know that the full moon is on 18th April 2022 and market can drift or drag until then. Below is the payoff chart showing how by shorting strangle on 8th April 2022 would have performed.

Option payoff chart:

By selling Strangle on 8th April Friday closing prices would have been already making money when majority is trying to figure out direction of the breakout.

Thus by selling both calls and puts one can benefit from the sideways action expected and eat the premium for the current week expiry. This is how Time and Options can be combined together to form powerful trade setups. The probability of success of the above strategy is above 95% by expiry.

So, one should also know Options strategy to benefit most from the ongoing market direction and do not ignore the moon which has such a big impact on stock markets.

Learn Option Trading Using Technical Analysis (OTTA) – Be a part of the Elite group of Options trading and learn this simple strategy using Payoff chart, Volume profile, Intraday Option buying, Open Interest analysis, Option chain, Bollinger Bands breakout strategy in upcoming program on 23rd – 24th April 2022. Combine this with Master of Waves program (MOW) and learn Elliott wave, Neo wave and Time cycles in 28-29th May 2022, Both program together we call as BMW. Limited seats, Learn before the times run out on Early Bird ending on 15th April, know more