Torrent Power: Gann Levels and Time Cycles Signal Next Move

Feb 18, 2026

The Gann Square of 9 is a simple yet powerful tool for identifying key support and resistance levels, based on the principle that price moves in mathematical harmony. Certain levels act as magnets until they are decisively broken.

When combined with Time-cycle analysis, it helps to pinpoint high-probability turning point.

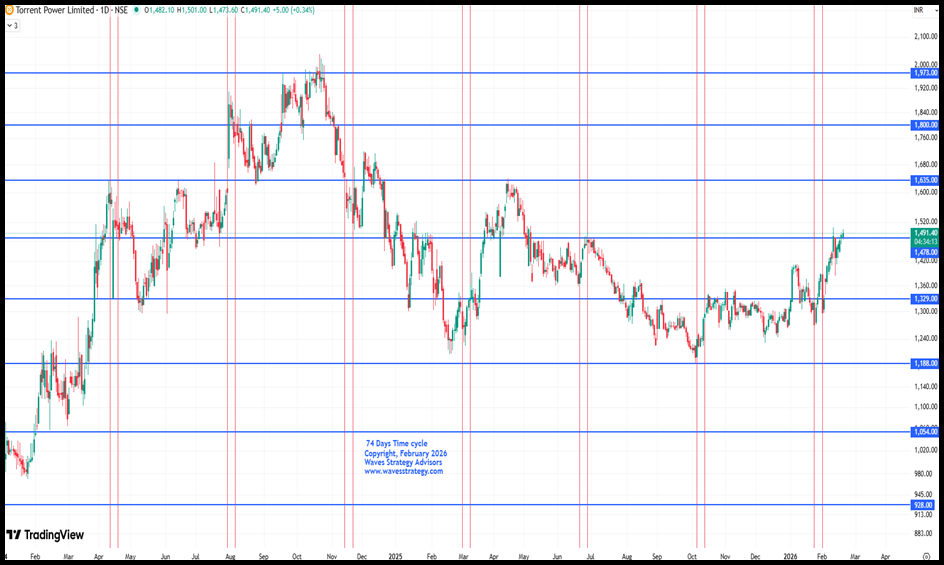

TORNTPOWER daily chart with Time cycle and GANN square of 9

Technical analysis often works best when multiple tools align, and Torrent Power Ltd. is a classic example where time cycles and Gann levels have combined effectively to identify key turning points in price.

Role of the 74-Period Time Cycle

The vertical lines plotted on the chart represent a 74-period time cycle, which has consistently helped in timing important swing lows in the stock. Historically, Torrent Power has shown a tendency to form a meaningful bottom roughly every 74 trading days, and this rhythm has been remarkably reliable.

The most recent cycle low was formed around 23rd January 2026, closely aligning with the Gann support level of 1329. From this zone, the stock witnessed a strong rally of more than 13%, underlining the significance of this time-price convergence.

Crucial Resistance Levels as per Gann Square of 9

The horizontal levels on the chart are derived from the Gann Square of 9, which has repeatedly acted as a guide for support and resistance in Torrent Power. Recently stock broke above the Gann level of 1478 which has acted as a crucial level in Torrent power and now next Gann level to watch out for is near 1635.

When combined both, Time cycle and Gann level can work like magic revealing the hidden structure of the market.

In a nutshell, Torrent Power Ltd. is currently hovering around the critical Gann level of 1478. A sustained breakout above 1505 could open the door for further upside, potentially driving prices toward the 1635 zone. On the downside, 1329 remains a key support level, and as long as prices stay above this base, the broader structure continues to favor the bulls.

Brahmastra Mentorship: Timing the Markets

A limited-seat mentorship program focused on:

- Basics to advanced technical analysis

- Elliott Wave & Neo Wave

- Time cycles

- Stock selection algorithms

- Complete understanding of chart patterns

- Exclusive mentorship sessions

- Simple, practical trade setups that actually work

Fill below form for more details