BankNifty: Why Elliott wave, candlestick and moving average provide best trading opportunities?

Mar 17, 2021

While trading the market it is important to understand the behavior of the market. We believe that basic as well as Advanced Elliott wave with candlestick and moving average can help to capture the next trend.

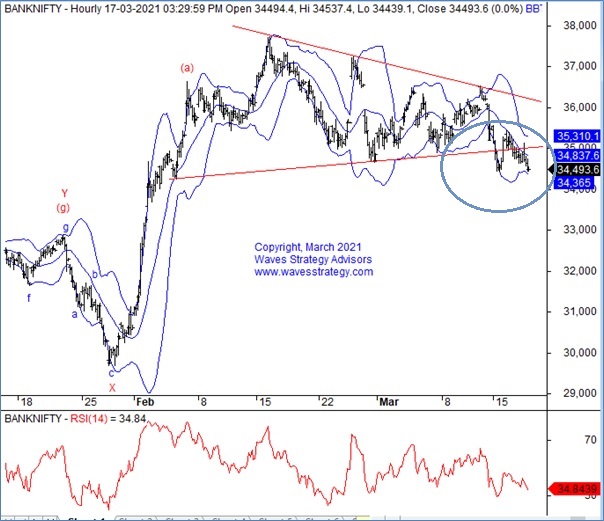

Look at the below chart of BankNifty published in the equity research report on 15th March morning before markets opened – “The Financial Waves short term update“

BankNifty 60 mins chart: (Anticipated as on 15th March 2021)

BankNIfty 60 mins chart: (Happened as of now)

Wave analysis: Following was mentioned on 15th March when the index was was near 35476 levels.

Wave analysis:

Bank Nifty continues to move in a lack luster fashion. In the previous session the index lost 1.23%.

On the weekly chart we can see that for two consecutive weeks price formed Doji like candles with strong rejection on the upside indicating overall weakness in the index which can persist in the coming week as well.

On the daily chart Bank Nifty seems to be hovering near the 25-day EMA. In the previous session the index formed an outside candle and managed to close below the prior day low. Hence as per the bar technique the short-term bias is now bearish as long as we do not see a close above the prior day high. As per wave theory price is moving in the form of wave z.

As shown on hourly chart, we can see that post wave X we are witnessing wave Z unfolding but the pattern after wave (a) is not very clear yet. Price seems to be forming some kind of triangle like pattern but the internal counts are not clear. A break below 34900 can inject selling pressure while a break above 36500 can result into a short-term upside move.

In short, Bank Nifty seems to be sideways with a slightly negative bias. Price can move in a wide range between 34900-36500 levels. A break below 34900 followed by 34650 can inject strong selling pressure.+

Happened: The Index performed precisely as expected recently on 17th March the price has made its low near 34435 levels.

Subscribe to the Intraday / Positional calls on Nifty, Bank Nifty, Stocks Futures and Options and get free research report along with it. Get access here

Trade with me – 3 months of Mentorship starts in 3 Days – “Life transformation” is what most of our existing mentees have been calling the program. Capture the big trends using simple ways of understanding institution activities which had been available only to a limited few so far. Take this leap for the lifetime investment. For more details contact us on +919920422202