Bank Nifty BANG ON as per Neo Wave Diametric Pattern and OI Profile

Nov 30, 2021

Like this Article? Share it with your friends!

Bank Nifty and Nifty both crashed over the past few days but this was completely predictable. We have shown a chart of Bank Nifty on 25th November when it was near 37200 levels and expected a crash below 36000 levels.

Below is the chart which was published – here is the link for reference

Bank Nifty followed the guidelines of Neo wave Diametric pattern to the point with very high accuracy.

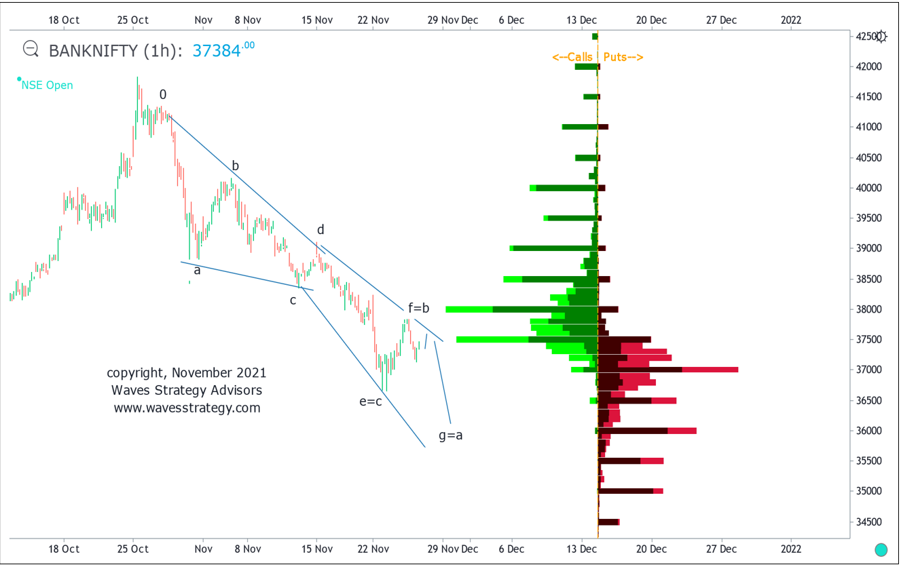

Bank Nifty hourly chart – Anticipated on 25th November 2021

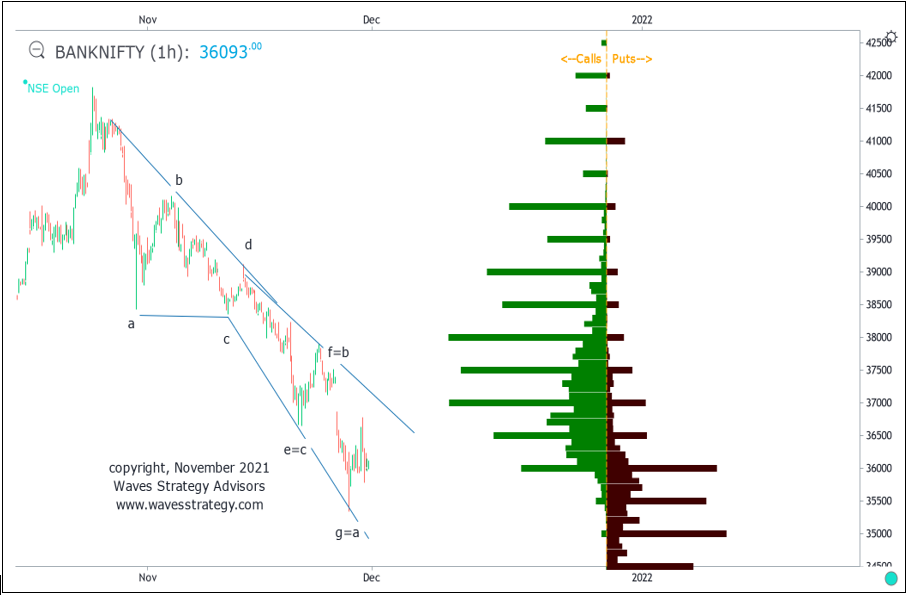

Bank Nifty hourly chart – Happened

Following was mentioned on 25th November 2021 research - Bank Nifty has been forming precise Diametric pattern which is a 7 legged correction. This pattern is described in Neo wave with all legs corrective in nature. Forecasting can be done as per following relationship between each of the legs as follows: Wave g = wave a, Wave f = wave b, Wave e = wave c. The above is a guideline and helps a trader to trade accordingly. We are combining Open Interest profile as well along with it for high conviction trade setups

Open interest profile: suggests that there is highest call open interest at 38000 levels and highest change in Call OI is at 37500 and so crossing this zone can be challenging ….Now that we have these crucial OI data and Elliott wave pattern it seems that there can be a minor pullback but not necessary post which Bank Nifty can start moving lower again towards 36400 – 36000 levels. BANG ON!

Happened: We can see a crash of more than 1000 points the very next day in this index which clearly showcased that by combining these simple methods of Elliott wave and Open Interest analysis it is possible to trade despite of the news or events that majority is focusing on. On 25th November evening many started worrying about the new variant outbreak of Covid-19 and attributed that to the reason of the down move. However, Elliott wave, Neo wave and Open interest profile clearly suggested that a leg on downside should resume along with the targets.

In a nutshell, one should focus on chart, studies and indicators along with Elliott wave pattern and form strategies on Options accordingly.

Most Advanced Training on Technical Analysis - Learn to Trade Options with step by step trade setups along with breakout strategy, Option Buying strategy, Volume and Open Interest profiling for Intraday, Swing trading, Also options can help to generate passive income if one understands the risk and accordingly take profitable positions. Become Market Wizard – BMW will combine Option Trading Using Technical Analysis (OTTA) on 11th – 12th December and Master of Waves (MOW) on 15th – 16th January. Trust me this will change you trade options and forecast the markets. Early Bird Ends on 30th November, know more here