Missed BPCL Move? This 3-Tool Strategy Will Help You Catch the Next One

Oct 30, 2025

Volume profile helps to derive price action area which helps to identify accurate entry and exit. Along with this, Keltner Channel and KST combined is a powerful setup, one can use it directly to trade options.

This setup helps traders to catch the momentum early so that one can stay ahead of the majority crowd. This setup can be used in index as well as in stocks which can be seen below:

BPCL 30 Minutes Chart with Volume Profile:

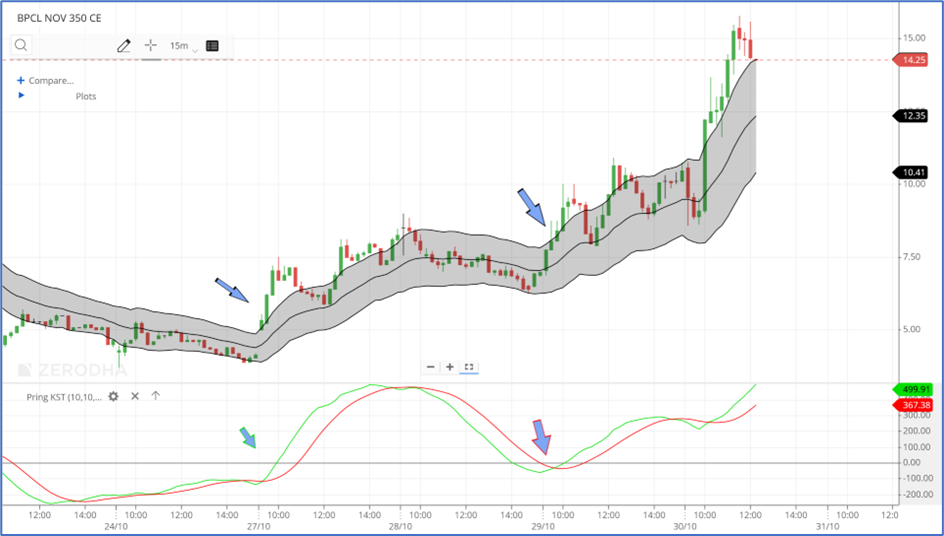

BPCL Nov 350 Call Option’s 15 min chart:

Volume profile shows big player activity. In BPCL, it’s Volume Point of Control (POC) area is near 338 levels. This is the area where highest cumulative volume has taken place which acts like a classic resistance or support. Recently prices gave a breakout of it and we saw a sharp rise as the Volume point of control was broken on the upside. Let us look at how to combine options to derive trade along with this information.

Options Trading Strategy -We have shown Keltner Channel and KST momentum indicator on the BPCL 25th November 350 Call Option.

Keltner channel shows if there is a significant movement and breakout in one direction. Also, just a breakout on Keltner Channel is not sufficient as it has to be looked in conjunction with momentum indicator. This has to be accompanied by KST crossover and it should trade above the 0 line.

So on, 27th October 2025, the confirmation candle took out the high of the breakout candle which gave a buy signal on Call Options according to the setup. Post which, the call option prices showed a sharp rise and made a high of 15 levels in today’s session!

The above strategy can be used for Intraday trading and for swing trading as well. Understanding exact application of Keltner Channel with KST is utmost important in order increase accuracy of this trade setup.

In a nutshell, it is important to know how to select Stike price selection, Volume profile and OI data which provides edge to the traders to determine major breakouts in the stocks or indices.

Brahmastra (Mentorship on Timing the market) – Learn to trade the market with an edge of Time cycles, Elliott wave, Neo wave concepts, Options strategy with 5 mantras of option trading, Open interest and volume profile, access to a private community group, stock selection scanner, Multibagger and Momentum stock identification technique, Mentorship sessions for the complete trading journey. Fill the form now: https://www.wavesstrategy.com/mentorship-form

Trishul Membership – Options Trading with Elliott wave, Neo wave, Ichimoku cloud, and sacred science of trading & forecasting is covered in the Options Mantra Live Sessions - 8th - 9th Nov & Sutra of Waves Live Session - 6th - 7th Dec. Limited seats available.