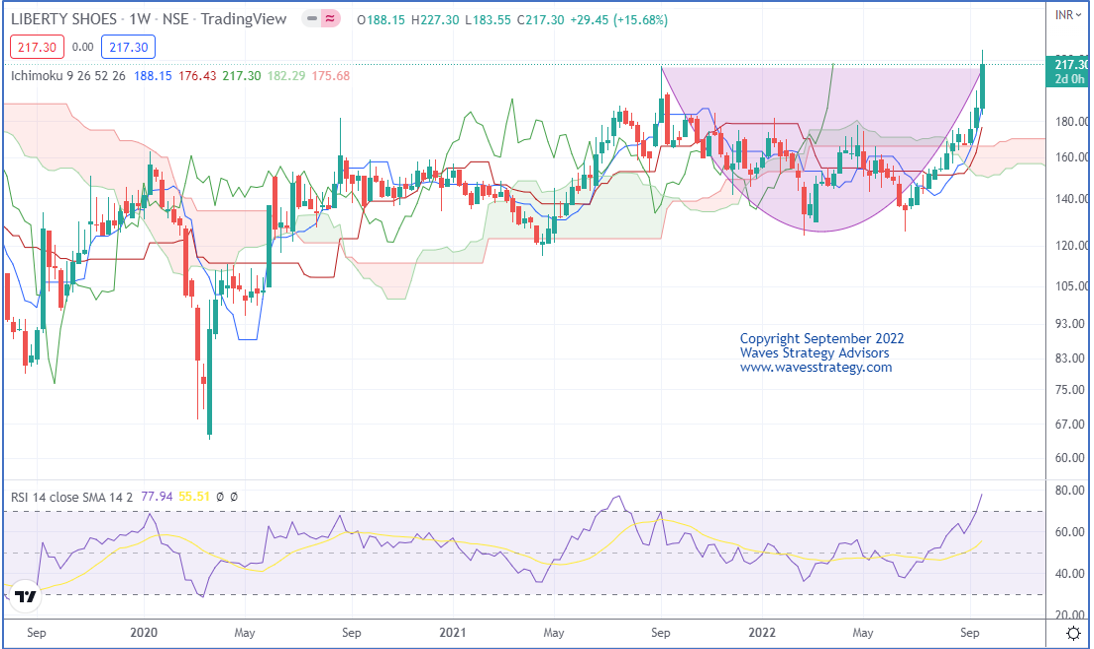

LIBERTY SHOES: Combining Rounding Bottom with Ichimoku cloud

Oct 10, 2022

Like this Article? Share it with your friends!

While trading the market it is important to understand the behaviour of the market. Using price action along with indicators like Ichimoku clouds we can predict price moves in stock with high accuracy.

We published LIBERTY SHOES analysis in "The Financial Waves Short Term Update" on 22nd September which our subscribers received pre-market every day. Check out below the detailed research report that we published.

LIBERT SHOES Weekly chart as on 22nd September 2022: (Anticipated)

LIBERTY SHOES Weekly chart as on 10th October 2022: (Happened)

Wave analysis as on 22nd September 2022:

On the weekly chart, in the previous session prices formed a bullish candle. A weekly close above 216 which confirms a breakout of the rounding bottom pattern. Price is trading above the Ichimoku cloud which indicates that the short-term bias is bullish.

In short, the trend for this stock is positive. Use dips toward 212-215 as buying opportunity for a move toward 236-240 levels as long as 204 holds on the downside.

Happened: The stock moved as we expected. LIBERTY SHOES have given a breakout of rounding bottom with huge volume which was a bullish sign. Within two weeks, the stock made a high of 346 levels which is more than 60% from the given levels. In such a volatile market, the stock is holding well at higher levels.

Master of Cycles – Learn the complete science of Time along with Gann square of 9, Hurst’s Time cycles for short-term trading to long-term investments in Stocks, Commodities, and Forex using Futures and Options. Only a few talks about time but trust me it works if you know how to apply it. Ever wondered whether the time is right for the stock you holding in your portfolio? Learn it and see yourself, Live Event on 15th – 16th October with follow up session, Know more

Mentorship on Timing the market – Want to trade time along with the Elliott wave and Neo wave, with Live trading sessions? Join this more than 3 Months of Mentorship session. Know more