Nifty Weekly Option Writing Strategy Using Ichimoku Cloud!

Dec 07, 2021

Like this Article? Share it with your friends!

Option writing in the index can be a way of generating regular income. A strategy with a high win rate in weekly options can fetch great returns. Check out this Nifty weekly option selling strategy using Ichimoku clouds.

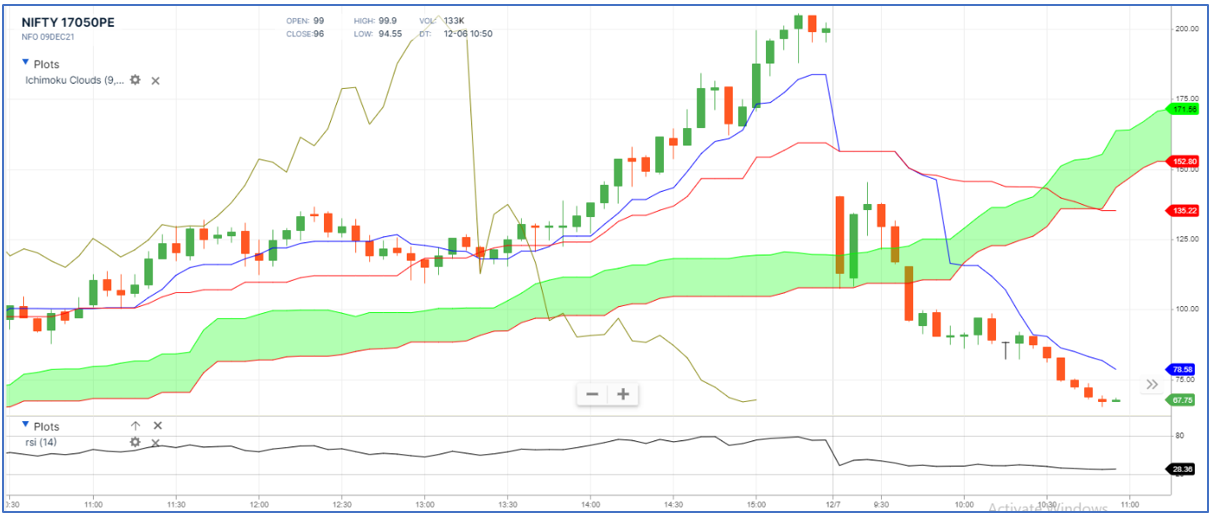

Nifty 17050 PE 9th December 5 min chart ( As of 7th December 2021)

The following option strategy works best on weekly index options. We will be using ATM options on the 5 min time frame for best results.

We can see in the 5 min chart of Nifty 17050 PE (9th December weekly expiry) above that we have applied the Ichimoku cloud indicator. The shaded region in green is the cloud. The blue line is called the conversion line and the red line is called the base line of the Ichimoku cloud.

When the option is ATM we can see that price will be above the cloud. We can write options once we see a 5 min candle close below the cloud. The initial stop loss can be placed slightly above the cloud where the trade was initiated. As the premium starts to erode and the options start to become OTM, we can trail the stop loss using the conversion line. A 5 min close above the conversion line can be used to exit the trade when in profit.

This is a trend following strategy. Hence there is no Fixed risk reward in this trading system. The accuracy will be much higher as we are taking advantage of both positive Theta along with negative delta in our favor.

Master of Waves – Learn complete Elliott wave, Neo wave along with Time Cycles and equip with excellent trade setups for trading Intraday and positional along with forecasting the markets from very hour, day and months. 2 Days of Live event on 15th – 16th January 2022, Early Bird ends on 25th December, Know more here