Nifty Gann Square of 9: Target 25,361 Achieved - What Is the Next Move?

Jan 21, 2026

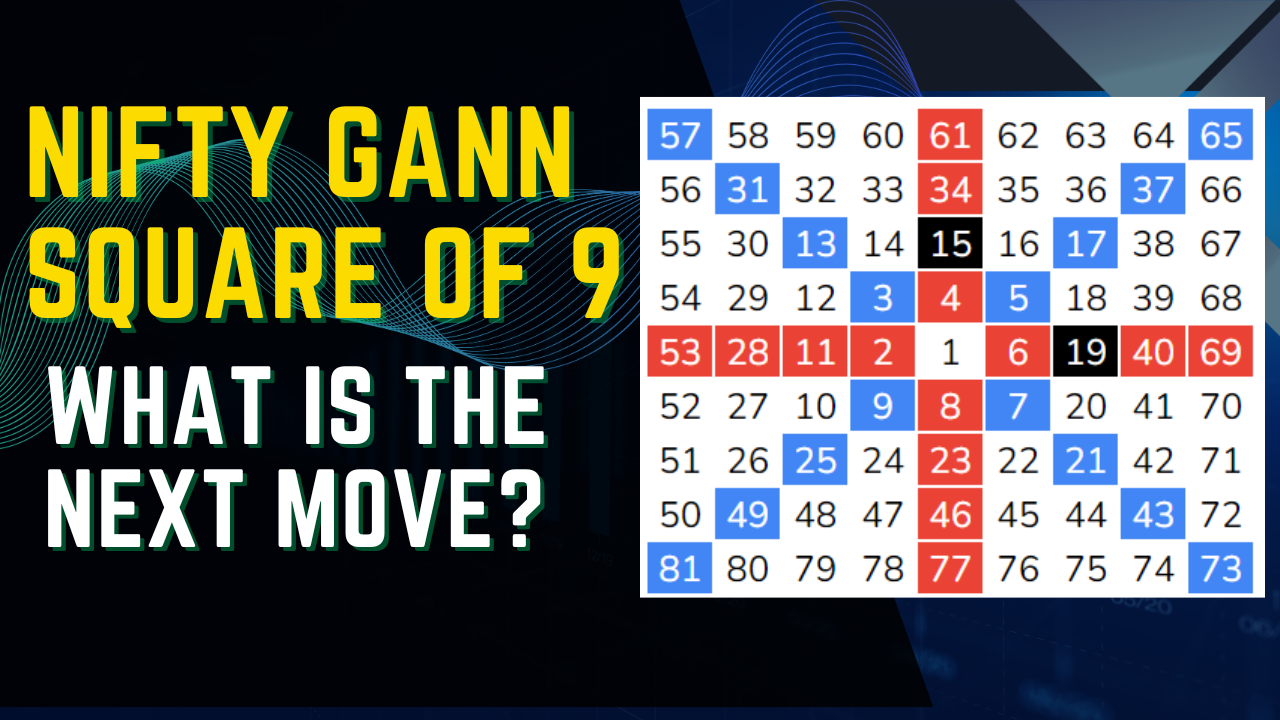

Most explanations on how to use Gann Square of 9 focus on formulas, angles, or historical references. In real trading, however, the usefulness of this tool lies in how price reacts when it reaches specific levels, not in memorizing its structure.

This article explains the Gann Square of 9 through actual market behavior, using Nifty’s recent decline as a working example.

What Makes Gann Square of 9 Relevant in Live Markets

Markets do not move randomly. They pause, accelerate, and hesitate near specific prices. The Gann Square of 9 helps map where these reactions are more likely to occur, especially during trending phases.

Nifty has been under consistent selling pressure for the last 11 trading sessions, and one important technical behavior stands out clearly: the index has been protecting the prior day’s high on a closing basis.

Instead of predicting tops or bottoms, the Square of 9 highlights:

-

Zones where selling pressure may intensify

-

Levels where buyers hesitate to step in

-

Areas where price often pauses before continuing

This makes it more useful as a decision-making framework rather than a forecasting tool.

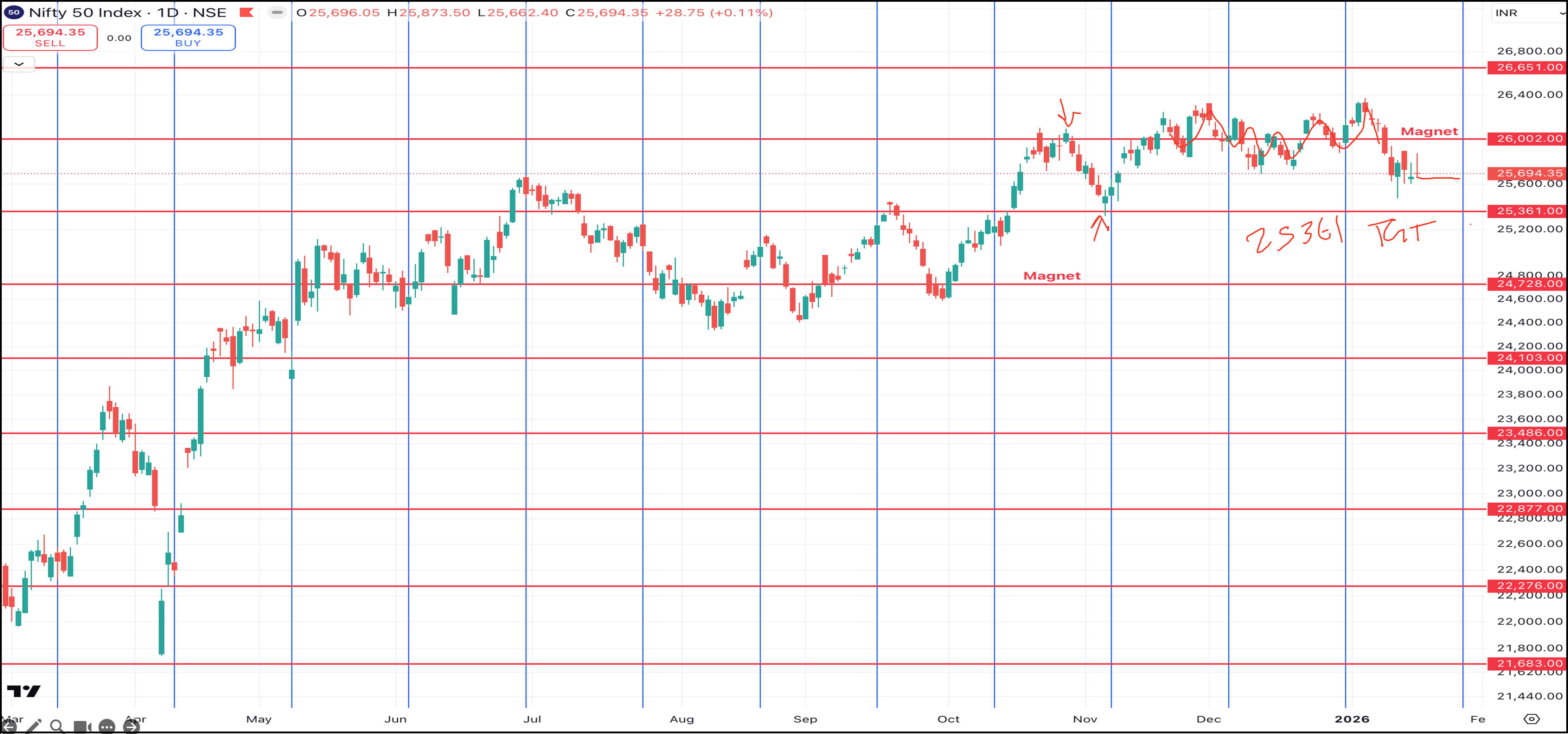

Against this backdrop, W.D. Gann’s Square of 9 methodology once again proved its precision, as the previously projected downside target of 25,361 has been achieved decisively in just two trading sessions.

Now the key question every trader is asking is:

What comes next after 25,361 in Nifty?

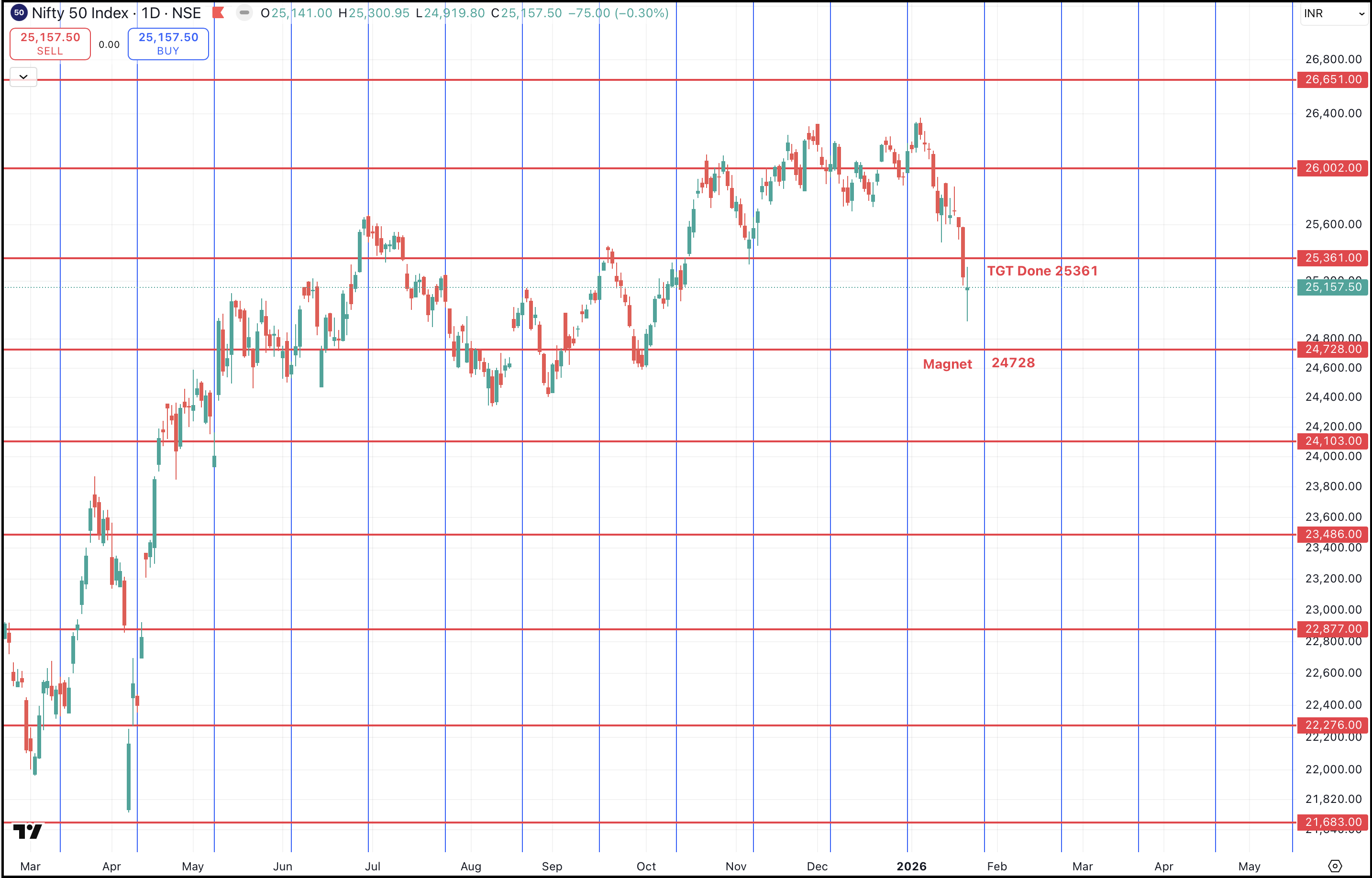

Nifty Daily chart – Anticipated on 17th January 2026

Happened:

What Makes Gann Square of 9 Relevant in Live Markets

The Gann Square of 9 is one of the most widely used tools from W.D. Gann’s work. It is often referred to as part of the “sacred science” of markets, as it helps identify:

- Key price levels of reversal

- Strong support and resistance zones

- Areas where trend acceleration or deceleration is likely

As highlighted in the chart, Nifty was anticipated to move down towards 25,361, and the market respected this level with remarkable accuracy.

- The target was achieved swiftly within two days

- The move confirms the strength of the prevailing downtrend

- Momentum remains clearly bearish, with no structural trend reversal yet

With the fulfillment of this level, 25,361 now turns into an immediate resistance or hurdle for prices on any pullback.

Immediate Resistance: 25,361 in Nifty

Post target achievement, role reversal becomes critical in technical analysis.

- 25,361, earlier a downside objective, is now likely to act as:

- Immediate resistance

- Supply zone on intraday and short-term charts

Unless Nifty manages a sustainable close above the prior day’s high, any bounce towards this zone should be treated with caution.

Buying into such pullbacks may turn out to be a bull trap.

Next Downside Target Opens: 24,728

With 25,361 achieved, the next major downside target opens at 24,728, another crucial level derived from the Gann Square of 9.

Why is 24,728 so important?

- Historically, this level has acted as a strong magnet

- Price has oscillated around this zone multiple times in the past

- Such magnet levels often attract prices before a meaningful pause or reversal

This makes 24,728 a high-probability zone where we may see:

- Temporary stabilization

- Short-term consolidation

- Or at least a halt in the pace of decline

Expectation Near 24,728: Pause, Not Reversal (Yet)

It is important to set expectations clearly.

- A pause or sideways movement near 24,728 is possible

- This does not automatically mean a trend reversal

- Confirmation will only come with:

- Time-based stabilization

- Structural changes in price behavior

This is where time cycle analysis, when combined with Gann levels, becomes extremely valuable offering insight into both price and timing of potential reversals.

Kalchakra – Bracket Master of Cycles

📅 7th & 8th February

A rare and powerful training where you will learn:

- Time forecasting along with price targets

- Advanced time cycle techniques

- Integration with Gann Square of Nine

- Sacred market science used by few

⚠️ Seats are limited

⏳ Early-bird offer ending very soon

👉 For more details, click here.

Mentorship & Training Programs

Brahmastra Mentorship: Timing the Markets

A limited-seat mentorship program focused on:

- Basics to advanced technical analysis

- Elliott Wave & Neo Wave

- Time cycles

- Stock selection algorithms

- Complete understanding of chart patterns

- Exclusive mentorship sessions

- Simple, practical trade setups that actually work

Fill below form for more details