Nifty Outlook: Time Cycle Pressure, Key Levels & Options Strategy

Feb 12, 2026

The Nifty Index continues to trade within a well-defined range, respecting critical time and price levels that have been highlighted over the past several weeks. The market remains in a consolidation phase.

This report combines NeoWave structure, Time cycle analysis, Bollinger Bands® and options strategy insights to help traders navigate the current market environment.

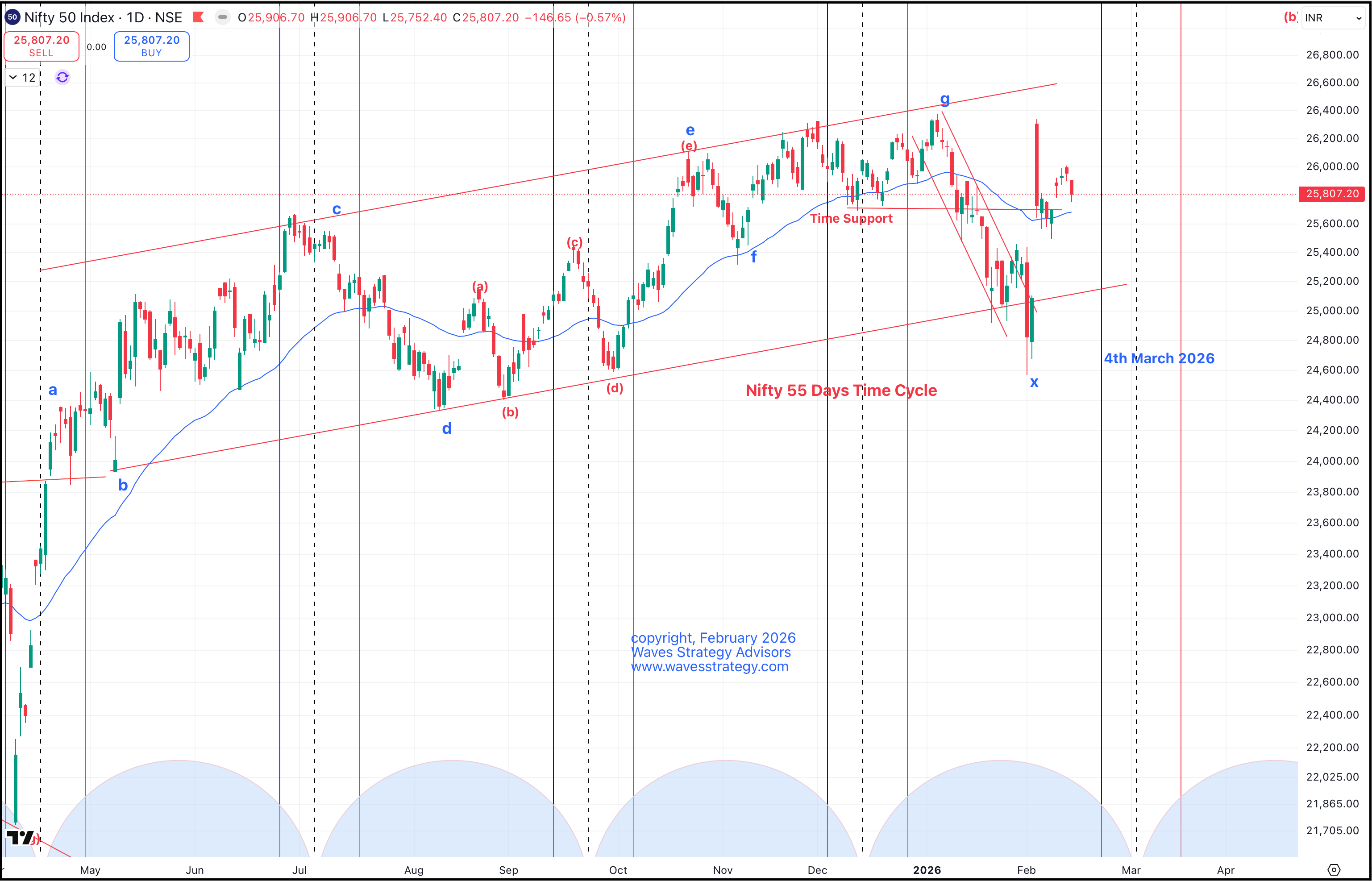

Nifty Daily Chart Analysis using Time Cycles

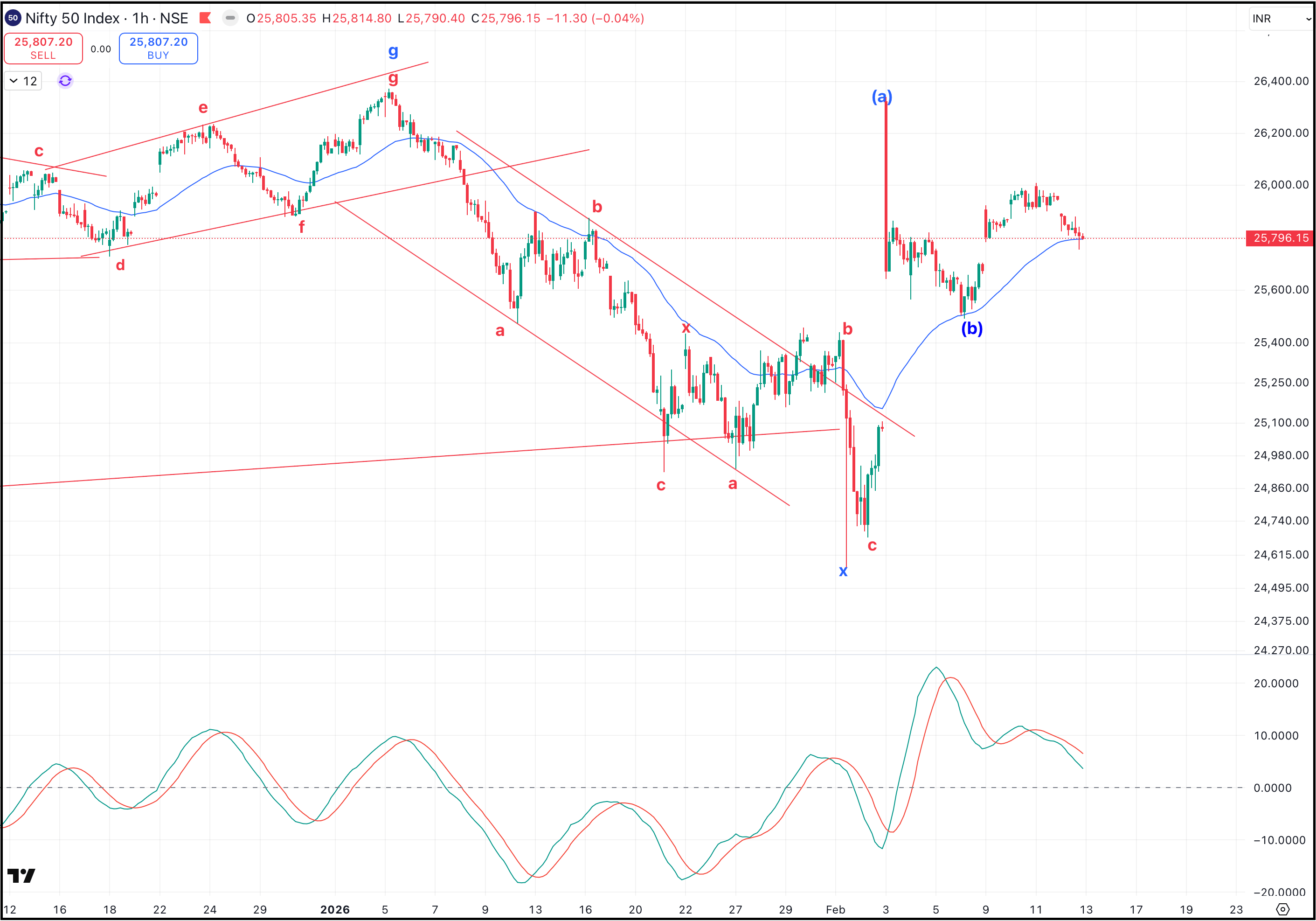

Nifty hourly Chart Analysis using Time Cycles

Key Support and Resistance Levels for Nifty

Nifty has been oscillating between important technical levels:

- Support (Time Support Zone): 25,728

- Resistance (Square of Nine Level): 26,002

These levels have been working exceptionally well, with prices repeatedly reversing within this band.

After 8 consecutive trading sessions, the index has now closed below the prior day’s low, indicating a short-term pressure. However, the market is still trading within a broader consolidation range rather than showing a confirmed trend reversal.

Nifty Time Cycle Analysis: Why the Market Is Consolidating

The primary reason for the ongoing sideways movement is the influence of a 55-day daily time cycle, which is currently on the sell side.

Important Time Windows:

- 55-day cycle zone begins: 20th February

- Major cycle date: 4th March

As highlighted in earlier outlooks, the lifetime high of 26,373 is unlikely to be broken before 4th March. Despite positive triggers such as the US–India trade developments, the index continues to respect this time-cycle resistance, confirming the dominance of time over news flow.

Short-Term Wave Structure (Hourly Chart)

On the hourly time frame:

- The recent decline near 25,491 completed a Wave b move.

- The current rise is unfolding as Wave c.

- Earlier expectations of an impulsive uptrend have changed.

- The overlapping price action suggests that the current rise is corrective in nature, not a strong directional trend.

This indicates a range-bound and choppy market, rather than a trending environment.

Bollinger Bands Behavior & Scalping Zone

Prices are currently reacting near the lower Bollinger Band support, indicating a mean-reversion environment.

Immediate Trading Levels:

- Above 25,880: Possible move toward 25,960

- Below 25,728: Downside pressure toward 25,630

Given the volatility compression and overlapping structure, the market has entered a scalping mode, where quick trades and defined risk strategies work better than directional bets.

Best Options Strategy for Current Market Conditions

In a falling volatility, consolidating environment, buying options may not be effective because:

- Implied Volatility (IV) is likely to decline

- Time decay works against option buyers

Instead, traders should focus on option-selling or spread-based strategies:

Recommended Strategies

- Short Strangle (Deep OTM) – Ideal for range-bound markets

- Bull Call Spread – For mild bullish expectations

- Bear Put Spread – For limited downside views

This is the phase where options strategy selection matters more than directional view.

NeoWave + Time Cycle + Options: A High-Probability Approach

The current market phase highlights the importance of combining:

- NeoWave Structure

- Hearst Time Cycles

- Options Strategies

- Volatility Analysis

When used together, these tools create a high-probability, risk-controlled trading framework, especially during non-trending markets.

Conclusion: Market View in a Nutshell

- Nifty remains range-bound between 25,728 and 26,002

- Short-term bias is mildly bearish

- 55-day time cycle pressure continues until early March

- Expect choppy, overlapping price action

- Focus on spreads or short strangle, not aggressive option buying

- Market remains in a scalping and volatility compression phase

Brahmastra Mentorship – Advanced Market Timing

Time the market to the very day, hour, and minute using a powerful combination of:

- Elliott Wave & NeoWave

- Hearst Time Cycle Analysis

- Stock Selection Algorithm

- Practical Risk & Money Management

Brahmastra – 3-Month Mentorship Program

- Learn structured market timing techniques

Fill the form below to know more